Cyclical upswing in Germany and in the world

The international economy

In 2017, the previously modest global economy gained considerable momentum. The centers of the upswing are China, the USA and the euro area. The strong global economy is likely to be due to the combination of three factors. First, extremely expansionary monetary policies have been supporting real economic activity for many years. Second, since 2015 the oil price is on average only about half as high as in previous years. Finally, Chinese demand for imported goods has contributed significantly to the revival of world trade. In 2018, monetary policy is expected to remain expansionary, albeit to a lesser extent. Fiscal policy is slightly expansionary, especially since a tax reform is to be expected for the USA. The latest corporate surveys also point to a continuation of the strong global economy. With advanced economies likely on average to face over-utilisation of economic capacities for the first time since the financial crisis and the Great Recession, companies will have reason to increase their investment to expand capacities. We also expect that the price and wage dynamics in this group of countries will pick up, possibly triggered by the recent increase in energy prices.

The German economy

The German economy has been in a cyclical upswing for four years now, but its strong performance in 2017 was still surprising. The upturn is broad-based; while the driving force of the years before was mainly consumption, in 2017 the economy received a strong stimulus from abroad, in particular from the rest of the euro area and from Asia. The improved export prospects have caused investment in equipment to expand markedly. In contrast, construction activity hardly increased during summer, despite large order backlogs. Apparently, the construction industry is currently coming up against capacity limits: In this sector, labour costs and prices are now increasing by more than 3% per year, and rising.

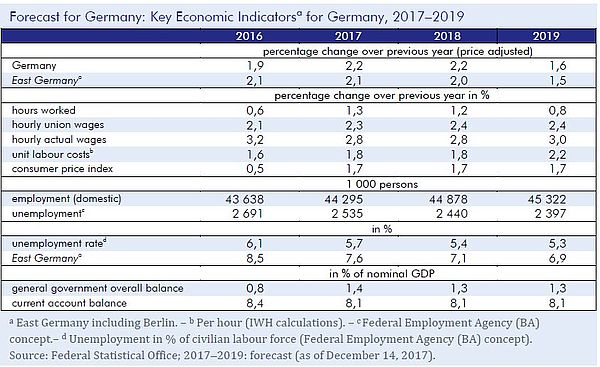

Still, there are many indications that overall the upswing will continue in 2018. Financing conditions in Germany are likely to remain very favourable, as the European Central Bank (ECB) will only slowly be reducing its expansionary monetary policy stance. Due to the budgetary surplus that is not only cyclical, but to a considerable degree also structural, fiscal policy has considerable room for maneuver. However, because at present it is unclear when a new government will come to power and what it will do, only discretionary measures that have already been decided on are included in the present forecast. On this basis, fiscal policy in 2018 is slightly expansionary. The international economic conditions should remain favourable. All in all, according to this forecast, GDP in Germany will increase by 2.2% in both 2017 and 2018. The unemployment rate will continue to decline in 2018. The public budget balance, at 1.3% in relation to gross domestic product, will be almost as high as in 2017.

The East German economy is expected to expand at slightly slower rates of 2.1% in 2017 and 2.0% in 2018. Because the manufacturing sector in East Germany is not as export-oriented as that in the West, it also does not benefit as strongly from the currently strong international economy.

This very favourable forecast for the German economy is associated with three main risks: First, it is not known which direction economic policy will take in the coming years, as long as there is no new government. A much more expansionary fiscal policy than assumed here is well conceivable, but by no means certain. Another risk concerns the international economy: Financial markets may see a revision of the current very optimistic valuation of many asset classes. In that case, the international environment could deteriorate rapidly. Finally, the favourable economic situation in Germany carries its own risks: If aggregate demand increases as strongly in 2018 as recently, it is conceivable that production capacities in many sectors will no longer be sufficient, and price increases will increasingly replace expanding real production. Such a development seems to be emerging already in the construction sector.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.