“The German Saver” and the Low Policy Rate Environment

It is widely claimed that “the German saver” suffers (i.e. generates significantly lower returns on her savings) in the low interest environment that Germany currently experiences relative to a high interest rate environment. With “low interest rate environment”, the observers tend to mean “low policy rates”, i.e. the European Central Bank’s (ECB) main refinancing rate.

24. September 2015

Inhalt

Seite 1

Tend German households to be net-savers?Seite 2

Return on average households’ asset holdingsSeite 3

Be concerned about the formation of bubbles? Auf einer Seite lesenTend German households to be net-savers?

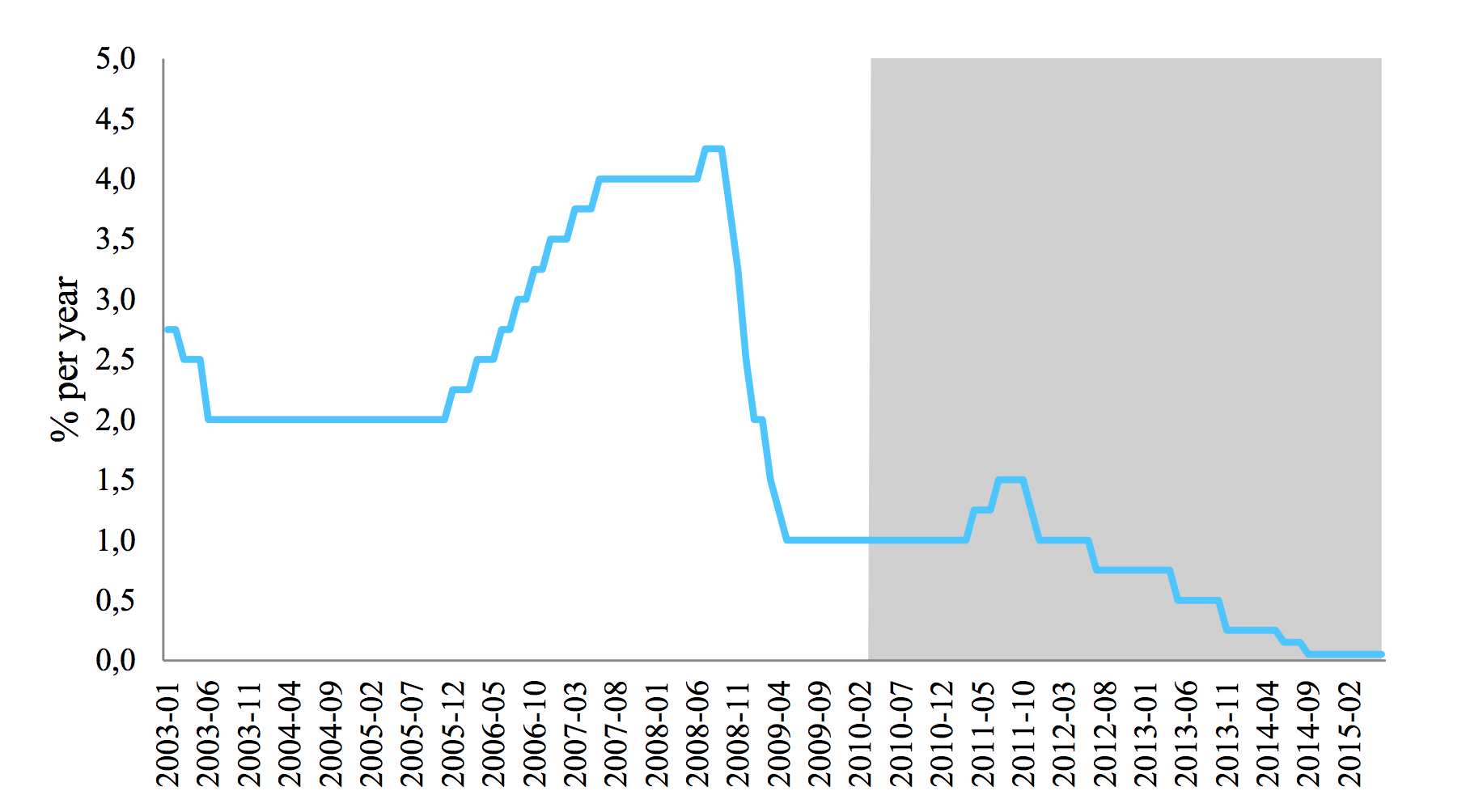

The ECB’s main refinancing rate is plotted in Figure 1 and shows indeed the much lower level during the past several years relative to earlier in the decade and even any other post-war period (not shown). The arguments at first glance seem convincing: German households tend to be net-savers. On average, they save significantly more than they borrow. The median household’s net wealth (including real estate) is about 50 thousand Euro and the median renter’s net wealth is about 10 thousand Euro.1

Figure 1: Monetary policy rate

ECB‘s main refinancing rate – Sources: Bundesbank’s Time Series Database; own calculations and illustration

Furthermore, they tend to save in liquid (savings-) deposits and life insurance plans, both of which are particularly affected by the low policy rate environment. In this report, we aim to contribute to this debate by empirically documenting six facts:

- The return on the portfolio of the average German household was significantly higher in 2010 to 2015, i.e. in the low policy rate environment, than in the pre-crisis period of 2003 to 2007 (see Table 1). In real terms, i.e. adjusted for inflation, these differences are even larger. At the same time, households benefited from lower interest on new loans.

- Aggregating these higher returns in Euro terms across 40 million households in Germany, we obtain a total Euro benefit of more than 364 billion Euro over a five-year period relative to 2003 to 2007.

- This is true across the income distribution in Germany, i.e. it holds for low income as well as for high income households, but only for homeowners. Renters were slightly worse off (at most a few hundred Euro over a five-year period). There are a number of reasons for this effect:

a. Interest rates on savings accounts and other deposits did not benefit very much from the high policy rate environment. Hence, the reduction in yield in the low policy rate environment is relatively small.

b. At the same time, returns on equity and, most importantly, real estate increased substantially in the low policy rate environment. The increase in returns overcompensates the loss due to savings accounts and life insurance assets. - The low policy rate environment re-distributed wealth from low income renters to high income homeowners. 66% of the total benefit of 364 billion Euro accrues to high income homeowners.

- The low policy rate environment benefits those households with a balanced portfolio that includes real estate and equity in addition to savings accounts and life insurance and hurts renters with savings only in deposits.2

- Households also benefited from lower interest cost on new loans taken out in the period. These effects are small (less than 20 billion Euro for all households during the five-year period), because the lower policy rates are not fully reflected in retail interest rates, especially for overdrafts and consumer loans.

We take the following approach to analyze the evolution of return on the average German household’s portfolio of assets: In order to calculate the portfolio of the representative households in each income quartile, we use the Eurosystem household Finance and Consumption Survey (HFCS)3 from 2010.