Professor Dr. Tobias Knedlik

Aktuelle Position

seit 4/14

Research Professor

Leibniz-Institut für Wirtschaftsforschung Halle (IWH)

seit 3/14

Professor für Volkswirtschaftslehre, insb. internationale Wirtschaft

Hochschule Fulda

Forschungsschwerpunkte

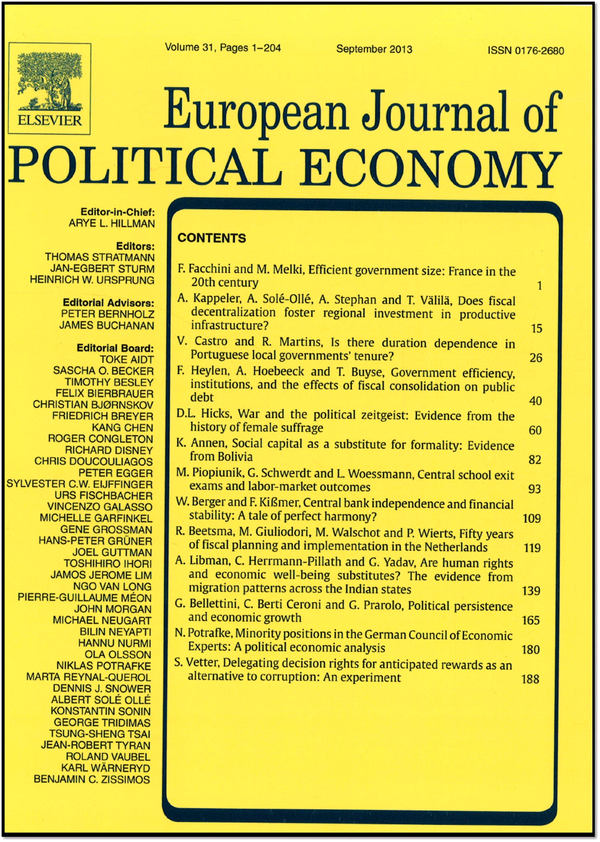

- Europäische und internationale Wirtschaftspolitik: insbesondere Finanzmarktkrisen

- Außenwirtschaft, Währungspolitik, internationale Organisationen

- Wachstum und wirtschaftliche Entwicklung

Tobias Knedlik ist seit April 2014 Forschungsprofessor am IWH. Seine Forschungsschwerpunkte liegen im Bereich Finanzkrisenprognose und -prävention.

Tobias Knedlik ist Professor für Volkswirtschaftslehre an der Hochschule Fulda. Zuvor war er am IWH tätig.