IWH Bankruptcy Update: German Bankruptcy Rates Remain Low in February

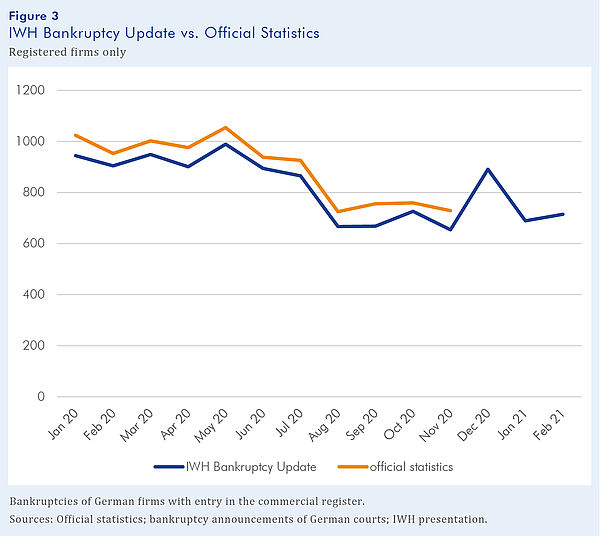

After ticking upward in December 2020, the number of companies filing for bankruptcy declined in January 2021, and then trended sideways in February. According to the IWH Bankruptcy Update, 715 companies reported bankruptcy last month. This is equivalent to month-over-month growth of 4%. Compared to the February 2020 figure, the number of bankruptcies was 21% lower.

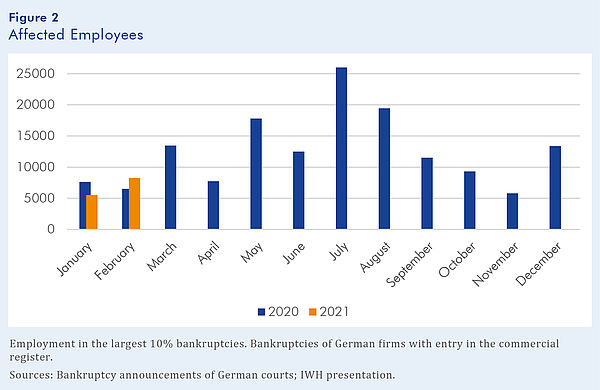

The largest 10% of companies (in terms of headcount) declaring bankruptcy in February employed a total of 8,250 people, according to IWH analysis. This means that 50% more jobs were affected by bankruptcy in February than in January 2021, and 26% more jobs were affected than in February of 2020. By contrast, the number of jobs impacted in the summer months of 2020 was many times higher.

Steffen Müller, IWH’s head of the Department of Structural Change and Productivity and the head of bankruptcy research at IWH, explains Germany’s continued low bankruptcy rates by pointing to the extensive government assistance provided to the private sector, the partial suspension of the obligation to file for bankruptcy, and the fact that many firms entered the crisis healthy. “While the endurance of companies in particularly hard-hit sectors can be questioned, we have yet to witness a dramatic rise in bankruptcy statistics, as predicted by some business surveys,” Müller says. “Leading indicators also fail to show higher bankruptcy rates in the coming months.”

The IWH Bankruptcy Update is a flash indicator, delivering fast, reliable information on insolvencies in Germany two months ahead of the comprehensive official statistics. It is based on public bankruptcy announcements of German courts combined with balance sheet information of the concerned companies. Because substantial delays can occur between a bankruptcy filing and public disclosure, some of the current numbers reflect bankruptcies that happened several weeks or months ago. The IWH Bankruptcy Research Unit is among Germany’s leading investigators of the causes and consequences of corporate bankruptcy.

For more on the IWH Bankruptcy Research Unit and the methodology underlying it, please visit https://www.iwh-halle.de/en/research/data-and-analysis/iwh-bank ruptcy-research/.

Whom to contact

For Researchers

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Insolvenzen in der Corona-Krise

in: IWH Policy Notes, 2, 2021

Abstract

Die Insolvenzzahlen sind trotz Corona-Krise im Jahr 2020 stark gesunken. Diese paradoxe Situation kann in erster Linie durch staatliche Unterstützungsmaßnahmen und abwartendes Verhalten bei den Unternehmen erklärt werden. Die Krise traf die meisten Unternehmen am Ende einer langanhaltenden wirtschaftlichen Boomphase und somit haben viele Unternehmen umfangreiche Reserven aufgebaut, die sie in Erwartung eines Nach-Corona Booms aufbrauchen. Obwohl eine Insolvenzwelle ab Frühjahr nicht auszuschließen ist, ist sie doch eher unwahrscheinlich. Der Staat muss seine Kräfte bündeln um ein Wiederaufflammen der Pandemie nach dem Sommer 2021 zu verhindern und gleichzeitig die Stützungsmaßnahmen bereits im Jahr 2021 beenden, um eine „Zombifizierung“ der Wirtschaft zu unterbinden.