Joint Economic Forecast Autumn 2019: Economy Cools Further – Industry in Recession

“German industry is in recession, and this is now also impacting the service providers catering to those companies,” says Claus Michelsen, Head of the Forecasting and Economic Policy Department at the host German Institute for Economic Research (DIW Berlin). “The fact that the economy is expanding at all is due primarily to the continuing positive spending mood of private households, which is being buoyed by good wage agreements, tax breaks, and the expansion of government transfers.”

Political uncertainties are ongoing worldwide and are having an impact on foreign trade by reducing the willingness of companies to invest. “Risks arising from an escalation of the trade war are particularly high. But a disorderly Brexit would also have costs: It would cause German gross domestic product, taken by itself, to be 0.4% lower in the coming year than if there was an orderly exit,” Michelsen adds.

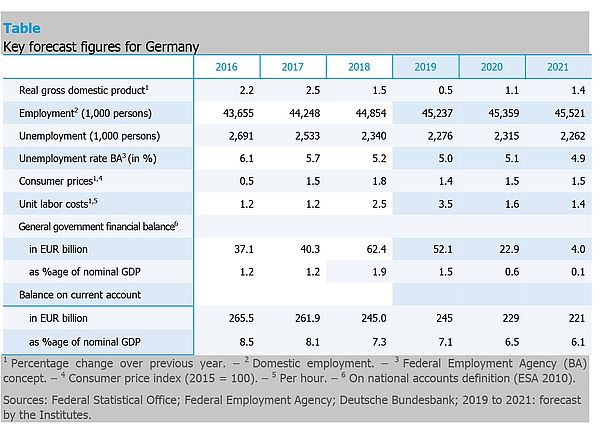

Employment growth has lost momentum as a consequence of the economic slowdown; industry even cut jobs recently. By contrast, service providers and the construction sector are still hiring. Consequently, the institutes forecast employment growth of 380,000 jobs this year. In the next two years, it is expected that only 120,000 and 160,000 new regular employment positions will be created. The unemployment rate will rise to 5.1% in 2020 from 5.0% in 2019 and is then expected to fall again to 4.9% in 2021. Consumer prices will continue to increase at a moderate pace by 1.4% in 2019, 1.5% in 2020, and 1.6% in 2021. Germany’s budget surplus remains hefty this year; it is expected to be around EUR 50 billion. However, this will dissipate by 2021 to around EUR 4 billion.

Aside from the economic slowdown, the main factors for this erosion are various fiscal measures such as additional pension benefits, an increase in child benefit, income tax relief, and not least the partial abolition of the solidarity surcharge. These measures are expected to amount to around EUR 22 billion this year, EUR 18 billion next year, and EUR 23 billion in 2021. In this way, monetary policy is delivering clear stimuli and supporting private consumption.

Since the spring, however, the risks for the German and the global economy have become more acute. Trade disputes between the US and China, but also conflicts within Asia, are causing uncertainty and putting strain on the global economy. A disorderly Brexit would also put strain on the European economy, and particularly the German economy. In Germany, moreover, the processes of structural change in automotive manufacturing present risks for the highly important auto market.

The Joint Economic Forecast was prepared by DIW (Berlin), the ifo Institute (Munich), IfW (Kiel), IWH (Halle), and RWI (Essen).

Full-length version of the report

Joint Economic Forecast Project Group: Industry in Recession – Forces Driving Growth Wane, Autumn 2019. Berlin 2019.

The full-length version of the report (in German language) will be available on the IWH website and at www.gemeinschaftsdiagnose.de/category/gutachten/.

About the Joint Economic Forecast

The Joint Economic Forecast is published twice a year on behalf of the German Federal Ministry for Economic Affairs and Energy. The following institutes participated in the autumn 2019 report:

- German Institute for Economic Research (DIW Berlin)

- ifo Institute – Leibniz Institute for Economic Research at the University of Munich

in cooperation with the KOF Swiss Economic Institute at ETH Zurich - Kiel Institute for the World Economy (IfW Kiel)

- Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

- RWI – Leibniz Institute for Economic Research in cooperation with the Institute for Advanced Studies Vienna

Scientific Contacts

Dr. Claus Michelsen

German Institute for Economic Research (DIW Berlin)

Tel +49 30 89789 458

CMichelsen@diw.de

Professor Dr. Timo Wollmershäuser

ifo Institute – Leibniz Institute for Economic Research at the University of Munich

Tel +49 89 9224 1406

Wollmershaeuser@ifo.de

Professor Dr. Stefan Kooths

Kiel Institute for the World Economy (IfW Kiel)

Tel +49 341 8814 579 oder +49 30 2067 9664

Stefan.Kooths@ifw-kiel.de

Professor Dr. Oliver Holtemöller

Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

Tel +49 345 7753 800

Oliver.Holtemoeller@iwh-halle.de

Professor Dr. Torsten Schmidt

RWI – Leibniz Institute for Economic Research

Tel +49 201 8149 287

Torsten.Schmidt@rwi-essen.de

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Industrie in der Rezession – Wachstumskräfte schwinden: Gemeinschaftsdiagnose Herbst 2019

in: Dienstleistungsauftrag des Bundesministeriums für Wirtschaft und Energie, 2, 2019

Abstract

Die Konjunktur in Deutschland hat sich im laufenden Jahr weiter abgekühlt. In beiden Quartalen des Sommerhalbjahrs dürfte die Wirtschaftsleistung geschrumpft sein. Seit Einsetzen des Abschwungs zur Jahreswende 2017/ 2018 ist nunmehr ein Großteil der zuvor recht deutlichen Überauslastung der Produktionskapazitäten abgebaut. Die Gründe für die konjunkturelle Abkühlung sind in erster Linie in der Industrie zu suchen. Dort ist die Produktion seit Mitte letzten Jahres rückläufig, da sich die Nachfrage insbesondere nach Investitionsgütern in wichtigen Absatzmärkten abgeschwächt hat. Allmählich strahlt die Industrierezession auch auf die unternehmensnahen Dienstleister aus. Die Institute erwarten für das Jahr 2019 einen Anstieg des Bruttoinlandsprodukts von 0,5% und damit 0,3 Prozentpunkte weniger als noch im Frühjahr 2019. Für das kommende Jahr wird der Zuwachs ebenfalls schwächer eingeschätzt, nämlich auf 1,1% nach noch 1,8% im Frühjahr. Eine Konjunktur- krise mit einer ausgeprägten Unterauslastung der deutschen Wirtschaft ist somit trotz rückläufiger Wirtschaftsleistung im Sommerhalbjahr 2019 nicht zu erwarten, wenngleich die konjunkturellen Abwärtsrisiken derzeit hoch sind.