Productivity: More with Less by Better

Available resources are scarce. To sustain our society's income and living standards in a world with ecological and demographic change, we need to make smarter use of them.

Dossier

In a nutshell

Nobel Prize winners Paul Samuelson and William Nordhaus state in their classic economics textbook: Economics matters because resources are scarce. Indeed, productivity research is at the very heart of economics as it describes the efficiency with which these scarce resources are transformed into goods and services and, hence, into social wealth. If the consumption of resources is to be reduced, e. g., due to ecological reasons, our society’s present material living standards can only be maintained by productivity growth. The aging of our society and the induced scarcity of labour is a major future challenge. Without productivity growth a solution is hard to imagine. To understand the processes triggering productivity growth, a look at micro data on the level of individual firms or establishments is indispensable.

Our experts

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-Mail

President

If you have any further questions please contact me.

+49 345 7753-700 Request per E-MailAll experts, press releases, publications and events on “Productivity”

Productivity is output in relation to input. While the concept of total factor productivity describes how efficiently labour, machinery, and all combined inputs are used, labour productivity describes value added (Gross Domestic Product, GDP) per worker and measures, in a macroeconomic sense, income per worker.

Productivity Growth on the Slowdown

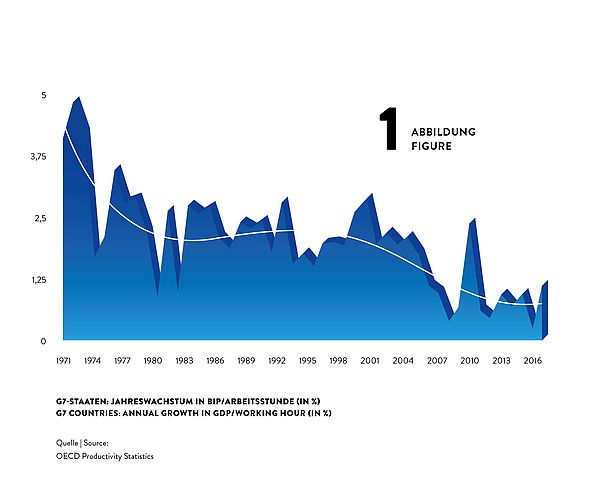

Surprisingly, despite of massive use of technology and rushing digitisation, advances in productivity have been slowing down during the last decades. Labour productivity growth used to be much higher in the 1960s and 1970s than it is now. For the G7 countries, for example, annual growth rates of GDP per hour worked declined from about 4% in the early 1970s to about 2% in the 1980s and 1990s and then even fell to about 1% after 2010 (see figure 1).

This implies a dramatic loss in potential income: Would the 4% productivity growth have been sustained over the four and a half decades from 1972 to 2017, G7 countries’ GDP per hour would now be unimaginable 2.5 times as high as it actually is. What a potential to, for instance, reduce poverty or to fund research on fundamentals topics as curing cancer or using fusion power!

So why has productivity growth declined dramatically although at the same time we see, for instance, a boom in new digital technologies that can be expected to increase productivity growth? For sure, part of the decline might be spurious and caused by mismeasurement of the contributions of digital technologies. For instance, it is inherently difficult to measure the value of a google search or another video on youtube. That being said, most observers agree that part of the slowdown is real.

Techno-Pessimists and Techno-Optimists

Techno-pessimists say, well, these new technologies are just not as consequential for productivity as, for instance, electrification or combustion engines have been. Techno-optimists argue that it can take many years until productivity effects of new technologies kick in, and it can come in multiple waves. New technology we have now may just be the tools to invent even more consequential innovations in the future.

While this strand of the discussion is concerned with the type of technology invented, others see the problem in that inventions nowadays may diffuse slowly from technological leaders to laggards creating a wedge between few superstar firms and the crowd (Akcigit et al., 2021). Increased market concentration and market power by superstar firms may reduce competitive pressure and the incentives to innovate.

Finally, reduced Schumpeterian business dynamism, i.e. a reduction in firm entry and exit as well as firm growth and decline, reflects a slowdown in the speed with which production factors are recombined to find their most productive match.

While the explanation for and the way out of the productivity puzzle are still unknown, it seems understood that using granular firm level data is the most promising path to find answers.

What are the Origins of Productivity Growth?

Aggregate productivity growth can originate from (i) a more efficient use of available inputs at the firm level as described above or (ii) from an improved allocation of resources between firms.

Higher efficiency at the firm level captures, e.g., the impact of innovations (Acemoglu et al., 2018) or improved firm organisation (management) (Heinz et al., 2020; Müller und Stegmaier, 2017), while improved factor allocation describes the degree of which scarce input factors are re-allocated from inefficient to efficient firms (‘Schumpeterian creative destruction’) (Aghion et al., 2015; Decker et al., 2021).

Most economic processes influence the productivity of existing firms and the growth and the use of resources of these firms and their competitors as well. The accelerated implementation of robotics in German plants (Deng et al., 2020), the foreign trade shocks induced by the rise of the Chinese economy (Bräuer et al., 2019), but also the COVID-19 pandemic, whose consequences are still to evaluate (Müller, 2021) not only effects on productivity and growth of the firms directly affected but at the same time may create new businesses and question existing firms.

While productivity can be measured at the level of aggregated sectors or economies, micro data on the level of individual firms or establishments are indispensable to study firm organisation, technology and innovation diffusion, superstar firms, market power, factor allocation and Schumpeterian business dynamism. The IWH adopts this micro approach within the EU Horizon 2020 project MICROPROD as well as with the CompNet research network.

As “creative destruction” may also negatively affect the persons involved (e. g., in the case of layoffs, Fackler et al., 2021), the IWH analyses the consequences of bankruptcies in its Bankruptcy Research Unit and looks at the implications of creative destruction for the society, e. g., within a project funded by Volkswagen Foundation searching for the economic origins of populism and in the framework of the Institute for Research on Social Cohesion.

Publications on “Productivity”

Structural Stability of the Research & Development Sector in European Economies Despite the Economic Crisis

in: Journal of Evolutionary Economics, No. 5, 2019

Abstract

When an external shock such as the economic crisis in 2008/2009 occurs, the interconnectedness of sectors can be affected. This paper investigates whether the R&D sector experienced changes in its sectoral integration through the recession. Based on an input-output analysis, it can be shown that the linkages of the R&D sector with other sectors remain stable. In some countries, the inter-sectoral integration becomes even stronger. Policy makers can be encouraged to use public R&D spending as a means of fiscal policy against an economic crisis.

The Regional Effects of a Place-based Policy – Causal Evidence from Germany

in: Regional Science and Urban Economics, November 2019

Abstract

The German government provides discretionary investment grants to structurally weak regions in order to reduce regional inequality. We use a regression discontinuity design that exploits an exogenous discrete jump in the probability of regional actors to receive investment grants to identify the causal effects of the policy. We find positive effects of the programme on district-level gross value-added and productivity growth, but no effects on employment and gross wage growth.

Gender Stereotypes still in MIND: Information on Relative Performance and Competition Entry

in: Journal of Behavioral and Experimental Economics, October 2019

Abstract

By conducting a laboratory experiment, I test whether the gender tournament gap diminishes in its size after providing information on the relative performance of the two genders. Indeed, the gap shrinks sizeably, it even becomes statistically insignificant. Hence, individuals’ entry decisions seem to be driven not only by incorrect self-assessments in general but also by incorrect stereotypical beliefs about the genders’ average abilities. Overconfident men opt less often for the tournament and, thereby, increase their expected payoff. Overall efficiency, however, is not affected by the intervention.

CEO Investment of Deferred Compensation Plans and Firm Performance

in: Journal of Business Finance and Accounting, No. 7, 2019

Abstract

We study how US chief executive officers (CEOs) invest their deferred compensation plans depending on the firm's profitability. By looking at the correlation between the CEO's return on these plans and the firm's stock return, we show that deferred compensation is to a large extent invested in the company equity in good times and divested from it in bad times. The divestment from company equity in bad times arguably reflects CEOs' incentive to abandon the firm and to invest in alternative instruments to preserve the value of their deferred compensation plans. This result suggests that the incentive alignment effects of deferred compensation crucially depend on the firm's health status.

East Germany Three Decades After the Wall Came Down: What has Been Achieved and What Should Economic Policy Do?

in: Wirtschaftsdienst, No. 7, 2019

Abstract

The persistent difference in productivity between East and West Germany not only results from the relative absence of large firms based in the East as many believe. Companies of all sizes exhibit an East-West productivity gap. The gap is larger in urban regions. Scarcity of skilled labour has emerged as the new barrier to business development. In order to boost productivity, economic policy should avoid additional subsidies that are conditional on creating jobs. Additionally, the potential of East German urban areas should be better explored. Mitigating the shortage in qualified workers requires in-migration of skilled labour from abroad, supported by an open mindset and environment.