German Economy Stays Stable Despite Shaky Environment

The world economy has turned to the worse during winter 2015/2016. Production expanded at a slower rate at the end of last year, and in January and up to mid-February, worldwide oil and stock prices fell markedly. Since then, prices have recovered, but not completely. At present, markets apparently see sliding oil prices less as good news for firms and households consuming oil; instead, for financial markets, low oil prices signal weakening production activity and a higher risk that many firms or even some economies dependent on income from oil sales will go bankrupt. The size of such insolvencies, according to this forecast, will, however, be rather limited, and as most advanced economies benefit from low commodity prices, the world economy will, in spite of the ongoing slow down in emerging markets, grow at about the same pace as last year.

However, as Oliver Holtemöller, Vice President of the IWH and head of its macroeconomic department puts it, “worldwide and political risks are substantial”. From his point of view, the combination of the economic slow down in China, the turmoil on financial markets, risks in the European banking sector, decreasing prices in the euro area, and of the European discord on handling the large flow of refugees, might entail a genuine crisis. In particular, shrinking demand of some important Chinese industries might affect the Chinese economy as a whole and the world economy in general. Long-run risks come from interest rates staying very low for a long time and from weak price dynamics in important advanced economies. Low interest rates jeopardize, for example, the viability of life insurance schemes that contain promises of a minimal pay-out. In addition, banks’ profit margins derived from term transformations might vanish if interest rates for all maturities tend to zero. Finally, the economies in the European Union bear the risk of rising political discord: For quite a few years, the case for political disintegration has gained support in many member countries. If this year in June, the British might vote for leaving the Union, the external value of the pound would go down significantly, as would investment in the United Kingdom and perhaps in other member states of the Union as well.

However worldwide and political risks are substantial.

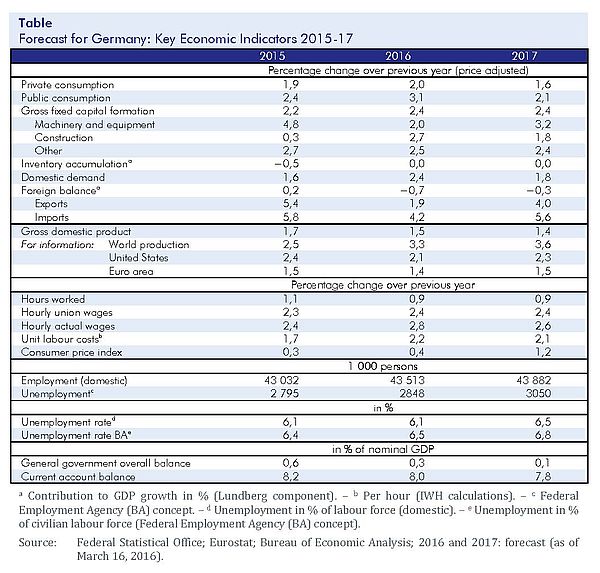

Weak external demand slowed the German economy down in the second half of 2015. Exports to China, for example, contracted. Internal demand, however, kept on expanding healthily. Fixed capital formation was, after an anemic summer, particularly strong at the end of the year, with strong contributions from housing and public investment. Total demand appears to have increased a bit stronger at the beginning of 2016: Industrial production jumped upwards in January, and employment continued to expand strongly. Orders for manufacturing firms, however, have increased by little, and in January and February, firms were more skeptical concerning the future than they were in the final quarter of 2015. Thus, the economy is likely to have a soft patch in the second quarter. For the second half of 2016, we expect demand to regain momentum, because many conditions continue to be quite favorable: Interest rates are very low, the external value of the Euro is – in spite of its recent limited revaluation – quite low as well, supporting the competitiveness of German producers, and both employment and incomes are rising markedly. Additional demand is caused by the high number of refugees, because public transfers are paid, dwellings are built or renovated, and administrative staff is being expanded, while taxes covering these public expenditures will not be raised. This might increase real GDP by about a quarter of a percentage point. Overall, according to this forecast, GDP growth will be at 1.5% in 2016. The consumer price level will, due to the renewed oil price fall and in general very low import price inflation, again be almost constant. Unemployment increases a bit, since a rising number of refugees will get the right to look for work but their integration into the labour market will take considerable time.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.