The German Economy Benefits from Strong Domestic Demand

In the summer of 2016, the world economy looks rather weak. It certainly was so at the beginning of the year, when growth in production was tiny in the US, and markedly lost momentum in China. In both countries, however, the underlying upward trends for internal demand appear to be intact. This is an important reason why stock prices have in most regions recovered from their steep fall during past winter. As gloom has receded a bit, oil prices have risen even quite strongly, from 30 US dollars per barrel (for Brent) in January to about 50 US dollars in early June. A turning point for the world business cycle is, however, not in sight. Extremely low yields for highly rated long-term government bonds are not only the result of unconventional monetary policies, but also of persistent pessimism on global growth prospects.

A British decision for an exit on June 23rd would mark the beginning of a long time of uncertainty about the future political framework for all European economies.

That said, economic dynamics in the EU appear to have been rather robust in the first half of 2016. Production in the euro area expanded markedly (by 0.6%) in the first quarter, driven by domestic demand that has been growing since summer 2015. The economy in the UK held up quite well, in spite of declining sentiment due to the imminent vote on EU membership. ‘A British decision for an exit on June 23rd would mark the beginning of a long time of uncertainty about the future political framework for all European economies’, says Oliver Holtemöller, Vice President of the IWH and Head of the Department Macroeconomics. Another risk for the international economy is the protracted weakness of world trade. What might stand behind it is the slowing glo¬ba¬li¬za¬tion of production processes that peaked around the middle of the noughties. Since then, not only the trend of trade growth is downwards orientated, but also the worldwide trend of labor productivity growth, as efficiency gains from the division of labor decline. Export-oriented economies like the German one would certainly be affected by a further drop in trade growth.

The German economy is still in a moderate upturn, supported by domestic demand. The sustained buildup of employment leads to an appreciable increase in private incomes, and the strong fall in energy prices has substantially raised the purchasing power of private households. Both factors support private consumption as well as residential investment, which in addition benefits from very low interest rates. Given the rather weak world economy, exports are bound to remain restrained in this and in the following year. Firms will increase their investment somewhat, not so much in order to expand the capital stock than to modernize it, and corporate investment will remain rather weak from a long-run perspective. Still, overall domestic demand is firm and stimulates imports. Accordingly, net exports will continue to subtract from gross domestic product.

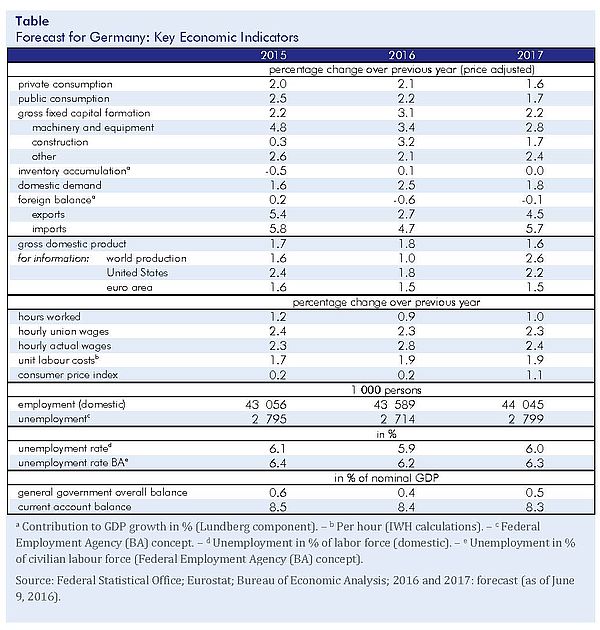

The German economy started the year 2016 on a strong footing: Production increased by 0.7%, which was more than double the rate seen in the previous two quarters. Besides the favorable underlying trend, special factors influenced this result. Forward looking indicators point to a less strong but still robust increase in production over the course of the year. Overall, real gross domestic product will increase by 1.8% in 2016. In 2017, the expansion of production will somewhat decelerate, although the quarter on quarter growth rates of 0.4% remain rather sturdy. All in all, we forecast gross domestic product to advance by 1.6% in 2017. Capacity utilization will be close to normal in both years.

So far, unemployment has further decreased in 2016, though the reduction was rather low given the sturdy increase in employment. The main reason for this is the very strong rise in the potential labor force, driven by high net migration. As of the middle of the year 2016, the number of registered unemployed persons will likely increase because more and more refugees will enter the labor market.

Public revenues will increase at a slightly weaker rate in 2016 than before, mainly due to tax reliefs. Since public spending is, given the expansionary fiscal policy stance and additional spending for refugees, increasing at a higher rate, public net borrowing will decrease from 0.6% in relation to gross domestic product in 2015 to 0.4% in 2016.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.