The German Economy: Still Robust Despite Sliding Sentiment

Since the recession in the euro area came to an end in 2013, the world economy grows at a moderate rate with minor disturbances. At present world production appears, after a soft patch during winter, to be expanding a bit faster. The Chinese economy in particular picked up in the second quarter. While growth in the USA was disappointing, mainly due to weak investment activity, the US economy still looks on an upward trend, since employment still expands healthily. The recovery in the euro area continues as well, although it lost some momentum in the second quarter.

Weaker export volumes and higher growth of imports are the relevant factors for the slowdown

The British vote to leave the EU has worsened the prospects for the country and, to a lesser extent, also for the rest of the EU. “The effects for the world economy should be limited,” Holtemöller says. “Indeed, world prices on stock markets have rebounded quite significantly from their Brexit induced fall after 23rd June.” The Bank of England has helped to stabilize expectations by lowering its Bank Rate and announcing purchases of government and corporate bonds. These steps will, however, not prevent the British economy from slipping into a mild recession in the coming quarters.

Shrinking British demand will impair the recovery in the euro area. Support for the monetary union comes, once again, from lower external financing costs, from fiscal policies that are, on average, mildly expansive, and from healthy employment growth in many member states. The recovery is, however, still only tentative in two large euro area economies: the unemployment rate in both France (10.3%) and Italy (11.4%) is still not coming down, while house prices continue on a downward trend; additional pressure on the Italian economy comes from the crisis of its banking sector due to the burden of nonperforming loans. In addition, as soon as the stimulus of real income gains due to fallen energy prices will fade in the coming quarters, the recovery of these two economies and of the euro area on the whole will slow down.

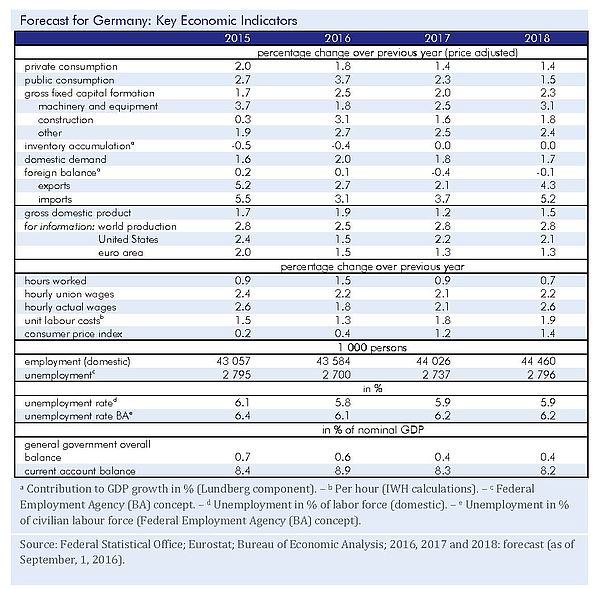

Output in Germany has expanded firmly in the first half-year 2016, with 0.7% in the first and 0.4% in the second quarter. The main reason for this was that the exports were up due to increased demand from Asia and Eastern Europe, after a phase of weakness in the second half-year 2015. Recently, however, the domestic economic activity has lost momentum. Growth of private consumption was somewhat lower than before, and gross fixed asset investment decreased considerably in the second quarter. Looking forward, production will continue expanding, but in the final quarter of 2016 it will do so at a markedly lower speed. This is indicated by the IWH- Flash-Estimator and the ifo business climate index. One reason is the beginning downturn in Britain, following the Brexit vote, as the country is an important destination for German exports. Moreover, the oil price appears to have stabilized in summer 2016 and thus, the stimulus of real income gains for German households from fallen energy prices will fade in the second half-year. All in all, gross domestic product will be 1.9% higher than in 2015. For 2017 monetary conditions are fairly favorable, but since they have been so for quite some time by now, their impact become gradually weaker. The stimulus from fiscal policy gets smaller as well. Production will expand approximately as fast as the potential output of the German economy, hence with an annual rate of about 1.5%, and capacity utilization will be about normal. Due to working-day effects, however, this results in an increase of the gross domestic product in 2017 of 1.2%. Consumer prices will continue to rise slowly, with a rate of 1.2%.

The effects for the world economy should be limited

The seasonally-adjusted number of unemployed persons has fallen until recently. However, next year unemployment will slightly rise, as more and more refugees will enter the labor market. The general government generates a substantial budget surplus. While tax reliefs in 2016 lower government revenues and the high number of refugees leads to additional expenditures, public revenues will expand once more strongly due to the favorable economic momentum. In sum, the surplus of public budgets in 2016 will be 0.5% in relation to the gross domestic product. In 2017 the general government balance (also structurally) will be 0.4% in relation to the gross domestic product.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.