Centre for Evidence-based Policy Advice (IWH-CEP)

The Centre for Evidence-based Policy Advice (IWH-CEP) of the IWH was founded in 2014. It is a platform that bundles and structures activities in research, teaching, and policy advice. IWH-CEP pursues the objective of creating better foundations for a causal analysis of policy implemented across different sectors.

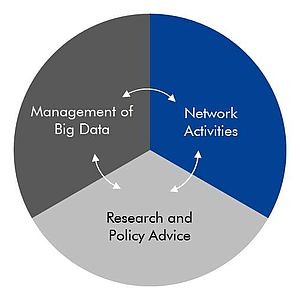

IWH-CEP is designed as a service unit and supports the activities in the research groups by providing access to a supra-regional research and policy advising network as well as access to data sets for causal analyses. IWH-CEP lies at the interface between three areas of responsibility and carries out coordination functions between them.

Tasks Team Events Projects Publications

IWH Subsidy Database Research Group "Evaluation of Subsidy Programmes"

The tasks of the IWH-CEP

The government intervenes in the market mechanism through a lot of policy instruments in order to achieve various economic objectives. However, for policy makers, it is important to know whether the originally intended objectives are also achieved. Scientific methods can make a significant contribution to this. These are necessary to establish a clear connection between a policy instrument and its effect. Against this background, the Centre for Evidence-based Policy Advice (IWH-CEP) at the IWH was founded.

Research and Policy Advice

Research and policy advice are organized via the different research groups of the IWH. This organizational structure allows to assess policy changes from both a macro and micro perspective and cover different sectors of the economy.

To gain a better understanding of structural changes and economic growth, a first focus is set on the evaluation of subsidy programmes for firms and regions, for example, the Joint Task of "Improving the Regional Economic Structure" (which is the most important regional policy support scheme in Germany) and the measures envisaged by the Coal Regions Investment Act (InvKG) are being evaluated on behalf of federal and state governments. The objective of the projects is to use advanced evaluation techniques to assess the impact of policy support measures. The projects are carried out under the responsibility of the IWH Research Group "Evaluation of Subsidy Programmes".

A second key area includes analyses on regulatory reforms and effects. Especially having in mind that after the recent financial crisis, a re-regulation of the financial system took place, it is of utmost importance to evaluate the effectiveness of the reforms as well as to assess whether there are unintended side-effects. In the context of the project The Political Economy of the European Banking Union, researchers in the financial markets department study how the directives underlying the European Banking Union are implemented across member states as well as whether the new regulatory framework has implications for banking stability and financial intermediation.

Set-up of a Network

The IWH-CEP sees itself as part of various initiatives in the field of evidence-based economic policy. This is to ensure the unit's visibility and the awareness of the issue among the scientific and policy community.

Set-up and Maintenance of Databases

The major challenge in the analysis of effects of government interventions and regulatory changes lies in the accessibility of administrative data. IWH-CEP advances into this direction by building up databases that can be shared with other researchers.

Therefore, the IWH Subsidy Database is set up, maintained and completed according to the (current) specialisation in the analysis of effects of industrial policy support schemes. Information about the funded projects alone is not sufficient to conduct causal analyses – corporate data provided by official and commercial statistics must be added; this is organised using record linkage techniques. This task is carried out at the IWH Research Data Centre.

Additionally, the financial market department has set up the website International Banking Library, which is a web-based platform for the exchange of research outcomes on cross-border banking. It provides access to data sources, academic research on cross-border banking, both theoretical and empirical, as well as information on regulatory initiatives. Thus, the website provides researchers and policymakers with a comprehensive overview of available data to conduct policy evaluation and the current stance of the literature on regulation and supervision of financial markets. The quarterly newsletter summarizes recent developments and is appreciateted by both academics and central bankers.

The website of the International Banking Library also allows access to the Financial Markets Directives Database. This database provides information about financial markets regulation in Europe since the last financial and sovereign debt crisis. One key element is the harmonization of rules for capital regulation, bank resolution and deposit insurance on the way to the European banking and capital market union. The first element of the database provides data on the implementation of the Capital Markets Union in the European Union (see Emlein, M.; Sfrappini, E.; Tonzer, L.; Zgherea, C.: Capital Markets Union: Database of Directives and Regulations. IWH Technical Reports 2/2022).

Your Contact

Research Group Head

If you have any further questions please contact me.

+49 345 7753-861 Request per E-MailEvents

The IWH-CEP organises the annual transfer conference "From Transition to European Integration". Under a current topic, the event connects representatives from politics, ministries, authorities, associations and companies with scientists from the IWH and its partner institutions. The opening speech is given by a prominent politician. After scientific lectures and discussions, a panel discussion concludes the one-day conference. The event is designed for the dissemination of IWH's research findings among political decision-makers and administrative professionals. There is also media coverage.

Projects

FLEXPANELDID: Stata module to perform causal analysis of treatments with varying start dates and durations

flexpaneldid: A Stata Toolbox for Causal Analysis with Varying Treatment Time and Duration

in: IWH Discussion Papers, No. 3, 2020

Abstract

The paper presents a modification of the matching and difference-in-differences approach of Heckman et al. (1998) for the staggered treatment adoption design and a Stata tool that implements the approach. This flexible conditional difference-in-differences approach is particularly useful for causal analysis of treatments with varying start dates and varying treatment durations. Introducing more flexibility enables the user to consider individual treatment periods for the treated observations and thus circumventing problems arising in canonical difference-in-differences approaches. The open-source flexpaneldid toolbox for Stata implements the developed approach and allows comprehensive robustness checks and quality tests. The core of the paper gives comprehensive examples to explain the use of the commands and its options on the basis of a publicly accessible data set.

09.2019 ‐ 09.2022

Establishing Evidence-based Evaluation Methods for Subsidy Programmes in Germany (EVA-KULT)

European Regional Development Fund (ERDF)

The project aims at expanding the Centre for Evidence-based Policy Advice at the Halle Institute for Economic Research (IWH-CEP).

Publications

Firm Subsidies, Financial Intermediation, and Bank Stability

in: IWH Discussion Papers, No. 24, 2022

Abstract

We use granular project-level information for the largest regional economic development program in German history to study whether government subsidies to firms affect the quantity and quality of bank lending. We combine the universe of recipient firms under the Improvement of Regional Economic Structures program (GRW) with their local banks during 1998-2019. The modalities of GRW subsidies to firms are determined at the EU level. Therefore, we use it to identify bank outcomes. Banks with relationships to more subsidized firms exhibit higher lending volumes without any significant differences in bank stability. Subsidized firms, in turn, borrow more indicating that banks facilitate regional economic development policies.

Capital Markets Union: Database of Directives and Regulations

in: IWH Technical Reports, No. 2, 2022

Abstract

In 2015, the European Commission adopted the Capital Markets Union (CMU) action plan. The plan aims to deepen financial integration and harmonize international standards for investments within the European Union (EU) and it outlines several actions to be implemented in order to address twelve key priority areas. We assemble a database of the legislative acts that implement the CMU. The dataset includes a list of directives and regulations at the EU level with information on publication, entry into force, and transposition dates as well as brief descriptions. This information might be useful in empirical analyses assessing the effectiveness of components of the CMU.

Completing the European Banking Union: Capital Cost Consequences for Credit Providers and Corporate Borrowers

in: European Economic Review, September 2022

Abstract

The bank recovery and resolution directive (BRRD) regulates the bail-in hierarchy to resolve distressed banks in the European Union (EU). Using the staggered BRRD implementation across 15 member states, we identify banks’ capital cost responses and subsequent pass-through to borrowers towards surprise elements due to national transposition details. Average bank capital costs increase heterogeneously across countries with strongest funding cost hikes observed for banks located in GIIPS and non-EMU countries. Only banks in core E(M)U countries that exhibit higher funding costs increase credit spreads for corporate borrowers and contract credit supply. Tighter credit conditions are only passed on to more levered and less profitable firms. On balance, the national implementation of BRRD appears to have strengthened financial system resilience without a pervasive hike in borrowing costs.

Umsetzung der Hilfen für die Flankierung des Kohleausstiegs in der brandenburgischen Lausitz – eine Zwischenbilanz

in: ifo Dresden berichtet, No. 3, 2022

Abstract

Die bisherige Vergabe der Hilfen für die Flankierung des Kohleausstiegs in den ostdeutschen Ländern wird zuweilen kritisch gesehen, so auch vor kurzem in dieser Zeitschrif. Wesentlicher Kritikpunkt dabei ist, dass die geplanten Projekte zu einem erheblichen Teil Maßnahmen unterstützen, die zwar die Lebensbedingungen vor Ort verbessern, aber nur einen geringen Beitrag zu einer erfolgreichen Strukturentwicklung leisten. Dieser Beitrag gibt einen detaillierten Einblick in die Mittelvergabe in der brandenburgischen Lausitz. Die wirtschafspolitischen Entscheidungsträger orientieren sich bei der Mittelvergabe an den im Investitionsgesetz Kohleregionen und im Lausitzprogramm 2038 verankerten Leitbildern. Das wichtigste Kriterium für die Auswahl der Projekte ist ihre Strukturwirksamkeit, welche die Bewilligungsbehörden des Landes in einem mehrstufgen Prozess eingehend evaluieren. Die empirische Bestandsaufnahme zeigt, dass die Mehrzahl der Projekte in der brandenburgischen Lausitz auf die Förderbereiche „wirtschafsnahe Infrastruktur“ und „Infrastrukturen für Bildung und Forschung“ entfallen, diese Bereiche überproportional mit finanziellen Mitteln untersetzt sind und sich überwiegend in den kernbetroffenen Gemeinden fnden.

Staggered Completion of the European Banking Union: Transposition Dates of the BRRD

in: IWH Technical Reports, No. 1, 2021

Abstract

In May 2014, the European Commission published the Bank Recovery and Resolution Directive (BRRD). The directive introduces rules on bank resolution and restructuring including a bailin tool. It constitutes the legal foundation underlying the Single Resolution Mechanism (SRM). Member countries of the European Union (EU) had to transpose this directive into national law by 31 December 2014 and implement the rules on resolution and restructuring of failing banks from 1 January 2015 onwards. However, many countries delayed the implementation. We assemble a dataset on national transposition dates of the BRRD across the EU-27 countries.

Identifying Cooperation for Innovation―a Comparison of Data Sources

in: Industry and Innovation, No. 6, 2020

Abstract

The value of social network analysis is critically dependent on the comprehensive and reliable identification of actors and their relationships. We compare regional knowledge networks based on different types of data sources, namely, co-patents, co-publications, and publicly subsidized collaborative R&D projects. Moreover, by combining these three data sources, we construct a multilayer network that provides a comprehensive picture of intraregional interactions. By comparing the networks based on the data sources, we address the problems of coverage and selection bias. We observe that using only one data source leads to a severe underestimation of regional knowledge interactions, especially those of private sector firms and independent researchers.

The Effects of German Regional Policy – Evidence at the Establishment Level

in: IWH Online, No. 5, 2020

Abstract

The “Joint Task ‘Improving Regional Economic Structures’ (GRW)” represents the most important regional policy scheme in Germany. The program provides non-repayable grants as a share of total investment costs to establishments (and municipalities) in structurally weak regions. The definition of eligible areas is based on i) a composite indicator measuring regional structural weakness and ii) a threshold determined by the European Union consisting of the population share of the respective country that lives in assisted regions. Responsible for the selection of the supported projects is the respective Federal State in which the GRW project is applied for.

Ostdeutschland - Eine Bilanz

in: One-off Publications, Festschrift für Gerhard Heimpold, IWH 2020

Abstract

Anlass dieser Festschrift ist die Verabschiedung von Dr. Gerhard Heimpold, dem stellvertretenden Leiter der Abteilung Strukturwandel und Produktivität am Leibniz-Institut für Wirtschaftsforschung Halle (IWH), aus dem aktiven Berufsleben in den wohlverdienten Ruhestand. Gerhard Heimpold forschte am IWH zu Aspekten der Regionalentwicklung Ostdeutschlands unter Beachtung des politischen und wirtschaftlichen Transformationsprozesses. Er gehört heute zu den wenigen Experten in Deutschland, die umfassende ökonomische Kenntnis über den gesamten Verlauf des Transformationsprozesses der ostdeutschen Wirtschaft seit Mitte der 1980er Jahre vorweisen können. Gerhard Heimpold hat im Laufe seiner akademischen Ausbildung und seiner ersten wissenschaftlichen Tätigkeit tiefe Einblicke in die Ausgestaltung und Funktionsweise der sozialistischen Planwirtschaft der DDR erhalten und konnte dieses Wissen nach dem Mauerfall 1989 in wichtige wissenschaftliche Beiträge auf dem Gebiet der internationalen Transformationsforschung einbringen.

Zu den betrieblichen Effekten der Investitionsförderung im Rahmen der deutschen Regionalpolitik

in: Wirtschaft im Wandel, No. 1, 2020

Abstract

Die Wirtschaft in den Industrieländern unterliegt einem ständigen Anpassungsdruck. Wichtige aktuelle Treiber des Strukturwandels sind vor allem die Globalisierung, der technologische Fortschritt (insbesondere durch Digitalisierung und Automatisierung), die Demographie (durch Alterung und Schrumpfung der Bevölkerung) und der Klimawandel. Von diesem Anpassungsdruck sind jedoch die Regionen in Deutschland sehr unterschiedlich betroffen. Regionalpolitik verfolgt das Ziel, Regionen bei der Bewältigung des Strukturwandels zu unterstützen. Ein besonderer Fokus liegt dabei auf Regionen, die ohnehin durch Strukturschwächen gekennzeichnet sind. Die aktuelle Regionalförderung in Deutschland basiert im Wesentlichen auf der Förderung von Investitionen von Betrieben und Kommunen. Die Evaluierung dieser Programme muss integraler Bestandteil der Regionalpolitik sein – schließlich stellt sich immer die Frage nach einer alternativen Verwendung knapper öffentlicher Mittel. Eine Pilotstudie für Sachsen-Anhalt zeigt, dass die im Rahmen der Regionalpolitik gewährten Investitionszuschüsse einen positiven Effekt auf Beschäftigung und Investitionen der geförderten Betriebe haben; bei den Investitionen allerdings nur für die Dauer des Projekts. Effekte der Förderung auf Umsatz und Produktivität von Betrieben in Sachsen-Anhalt waren nicht nachweisbar.

flexpaneldid: A Stata Toolbox for Causal Analysis with Varying Treatment Time and Duration

in: IWH Discussion Papers, No. 3, 2020

Abstract

The paper presents a modification of the matching and difference-in-differences approach of Heckman et al. (1998) for the staggered treatment adoption design and a Stata tool that implements the approach. This flexible conditional difference-in-differences approach is particularly useful for causal analysis of treatments with varying start dates and varying treatment durations. Introducing more flexibility enables the user to consider individual treatment periods for the treated observations and thus circumventing problems arising in canonical difference-in-differences approaches. The open-source flexpaneldid toolbox for Stata implements the developed approach and allows comprehensive robustness checks and quality tests. The core of the paper gives comprehensive examples to explain the use of the commands and its options on the basis of a publicly accessible data set.