Professor Dr Oliver Holtemöller

Current Position

since 3/14

Vice President

Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

since 8/09

Head of the Department of Macroeconomics

Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

since 8/09

Professor of Economics

Martin Luther University Halle-Wittenberg

Research Interests

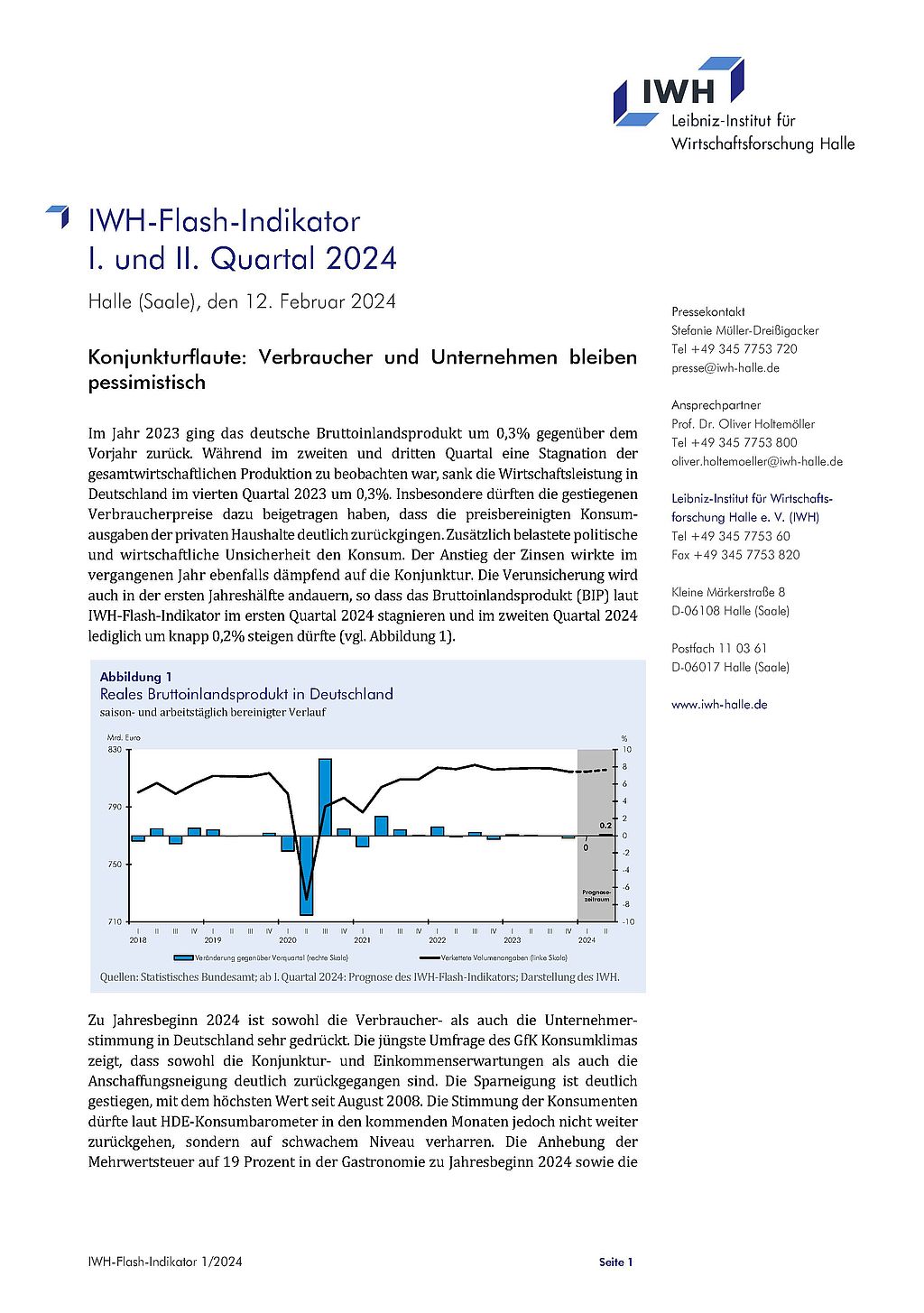

- quantitative macroeconomics, business cycles, and forecasting

- applied econometrics and time series analysis

- monetary economics

- macroeconomic policy

- environmental macroeconomics

Oliver Holtemöller is Professor of Economics at Martin Luther University Halle-Wittenberg and head of the Department of Macroeconomics at the Halle Institute for Economic Research (IWH) since August 2009. Since March 2014, he is also a member of the executive board of the IWH.

Oliver Holtemöller has studied economics, applied mathematics and practical computer science at the Justus-Liebig University in Gießen. He participated in the doctoral programme Applied Microeconomics at the Freie Universität Berlin and at the Humboldt-Universität zu Berlin from 1998-2001 and obtained his doctoral degree from the Freie Universität Berlin in 2001.

From 2001 to 2003, he was a collaborator in the National Research Center Quantification and Simulation of Economic Processes (SFB 373) at the Humboldt-Universität zu Berlin. From 2003 to 2009, he was an Assistant Professor in Economics at RWTH Aachen University.