High risk of corporate bankruptcy due to the corona shutdown

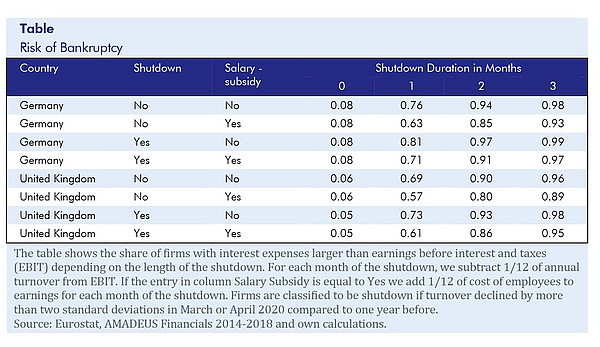

Since the outbreak of the Corona pandemic many countries have shutdown large parts of their economy. While this helps to mitigate the spread of the virus, the shutdown comes with severe economic costs. One negative consequence of the shutdowns is that firms lose turnover while costs are hardly reduced. In particular, firms need to serve their debt and pay interest to banks. In accommodation, for example, firms in Germany and in the United Kingdom have lost about 50% of turnover in March 2020 compared to one year before. The transport sector, travel agencies and many retail sectors are also heavily affected. The longer a shutdown lasts, the more firms will not be able to cover their interest expenses. In a one-month shutdown, 81% of firms in affected industries in Germany come under financial distress and 73% of firms in the United Kingdom (see Table). Financial distress is defined as a situation in which interest expenses exceed earnings before interest and taxes. If the shutdown lasts longer, about three months, nearly all firms in shutdown industries will face risk of bankruptcy and many firms in the other sectors will be financially distressed as well.

Both Germany and the United Kingdom have implemented furlough schemes which reduce salary payments and social security contributions of firms. This helps to some extent. However, even if the complete cost of employees is refunded by the state to shutdown firms, the risk of bankruptcy increases dramatically. Even in this case the risk of bankruptcy increases to 71% in Germany and to 61% in the United Kingdom. There are small differences between size groups of firms, but in general all size groups will exhibit a severe increase in the probability of bankruptcy.

The occurrence of bankruptcies may be staggered. The full extent will only be visible after some time. This implies huge economic risks. A large wave of bankruptcies might jeopardise the economic recovery and lead to a double-dip recession after the mitigation of shutdown measures has initiated an initial catching-up process. The economic risk should be considered in the design of further official measures to mitigate the Coronavirus pandemic.

Publication

Holtemöller, Oliver; Muradoglu, Yaz Gulnur: Corona Shutdown and Bankruptcy Risk. IWH Online 3/2020. Halle (Saale), 2020.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Corona Shutdown and Bankruptcy Risk

in: IWH Online, 3, 2020

Abstract

This paper investigates the consequences of shutdowns during the Corona crisis on the risk of bankruptcy for firms in Germany and United Kingdom. We use financial statements from the period 2014 to 2018 to predict how pervasive risk of bankruptcy becomes for micro, small, medium, and large firms due to shutdown measures. We estimate distress for firms using their capacity to service their debt. Our results indicate that under three months of shutdown almost all firms in shutdown industries face high risk of bankruptcy. In Germany, about 99% of firms in shutdown industries and in the UK about 98% of firms in shutdown industries are predicted to be under distress. The furlough schemes reduce the risk of bankruptcy only marginally to 97% of firms in shutdown industries in Germany and 95% of firms in shutdown industries in the United Kingdom in case of a three-month shutdown. In sectors that are not shutdown under conservative estimates of contagion of sales losses, our results indicate considerable risk of widespread bankruptcies ranging from 76% of firms in Germany to 69% of firms in the United Kingdom. These early findings suggest that the impact of corona crisis on corporate sector via shutdowns can be severe and subsequent policy should be designed accordingly.