IWH Bankruptcy Update: Bankruptcy Statistics Rise Again in March

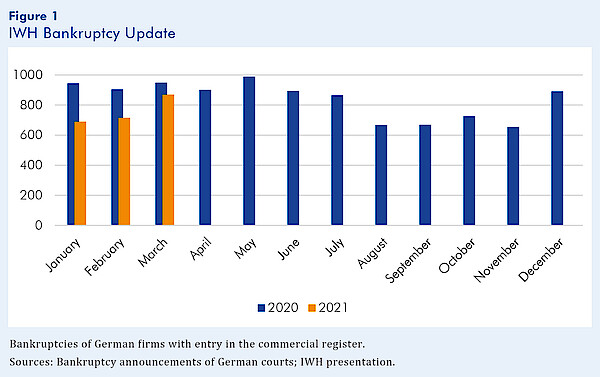

Following a modest increase in February, the number of firms declaring bankruptcy experienced an even stronger jump in March. According to statistics gathered by IWH, 870 firms with entry in the commercial register filed for bankruptcy last month. This represented a 20% increase over February – and was nearly as high as the figure from March 2020 (see figure 1).

Looking beyond the firms with entry in the commercial register, the last two months reveal a strong increase in the rate of bankruptcy among micro-enterprises and the self-employed. One possible reason for this trend – beyond the ongoing strain of the COVID-19 pandemic – is a legal change that went into effect in January 2021 making it easier for individuals to shed residual debt, thus reducing the negative consequences of bankruptcy.

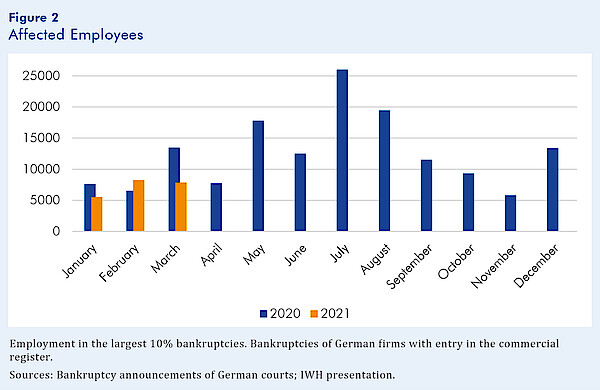

Of the firms that filed for bankruptcy in March, the top 10% in terms of headcount employed a total of nearly 8,000 people, according to IWH analysis. A similar figure was registered in February. This statistic was much higher during last summer, however (see figure 2).

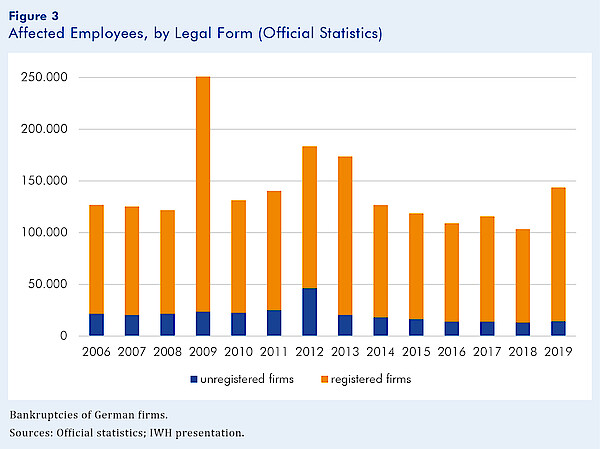

While the number of micro-enterprises filing for bankruptcy has increased, from an economic perspective the more crucial question is the size of the firms declaring bankruptcy and the number of jobs impacted. Indeed, micro-enterprises are responsible for a considerable share of the headline total, yet based on past statistics, they only account for some 10% of impacted jobs (see figure 3).

“The bankruptcy of numerous micro-enterprises is often less significant from a macro perspective than a handful of large corporate bankruptcies,” says Steffen Müller, head of the Department Structural Change and Productivity and the director of Bankruptcy Research at IWH. The absolute number of jobs lost, however, is only part of the issue: When a large firm goes bankrupt, the wage losses of employees are also much higher. “A new study shows that wage declines depend significantly the size of the firm going bankrupt. Employees laid off from a large firm due to bankruptcy suffer much larger wage declines than individuals whose micro-enterprise goes under,” Müller explains, noting that workers in the latter category frequently even earn more in their next job.

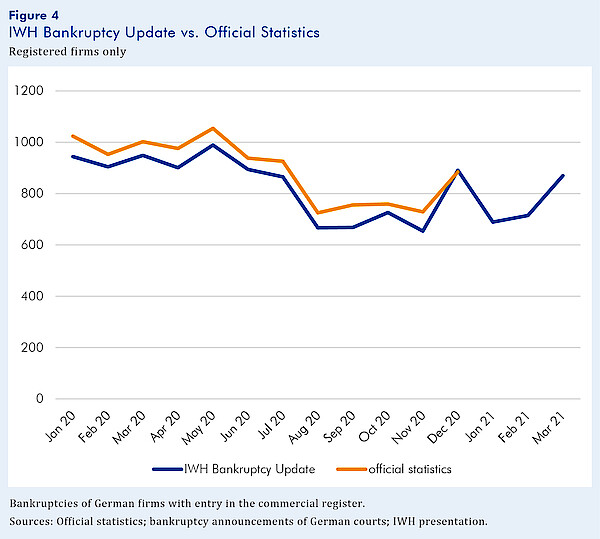

The IWH Bankruptcy Update is a flash indicator, delivering fast, reliable information on insolvencies of firms with entry in the commercial register in Germany two months ahead of the comprehensive official statistics. It is based on public bankruptcy announcements of German courts combined with balance sheet information of the concerned firms. Deviations from official statistics are small (see figure 4). The IWH Bankruptcy Research Unit is among Germany’s leading investigators of the causes and consequences of corporate bankruptcy.

For more on the IWH Bankruptcy Research Unit and the methodology underlying it, please visit https://www.iwh-halle.de/en/research/data-and-analysis/iwh-bank ruptcy-research/.

Whom to contact

For Researchers

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.