IWH FDI Micro Database

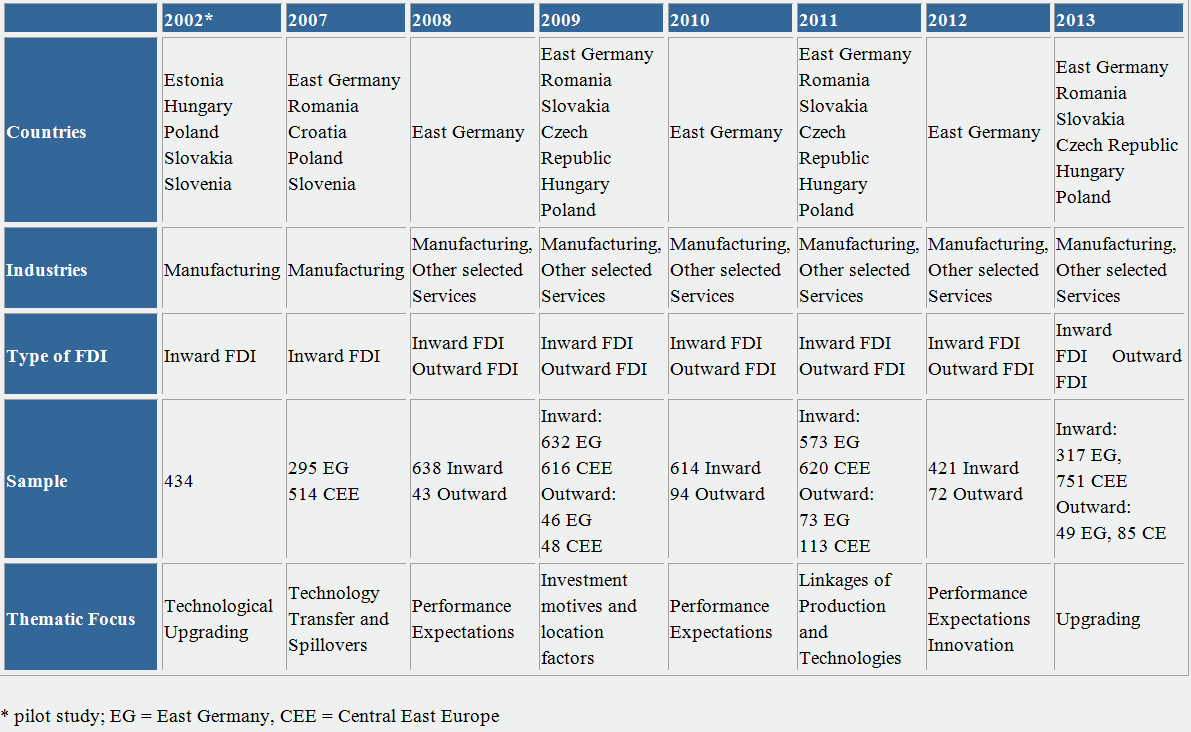

The IWH FDI Micro Database (FDI = Foreign Direct Investment) comprises a total population of affiliates of multinational enterprises (MNEs) in selected Central- and East European countries as well as East Germany, which was constantly updated throughout the duration of the project. From 2007 to 2013 an annual survey had been implemented in the manufacturing sector and in 2008 it was extended to cover selected services as well.

The research focuses on the analysis of locational factors of MNEs, the organisation of R&D and Innovation, as well as the potential for knowledge spillovers to the host economy. The IWH FDI Micro Database is analysed by an international network of researchers based in East and West European countries. The research results serve as topical input into policy consultancy at regional, national, and international levels.

In the medium term, the IWH FDI Micro Database offers a potential contribution to the international standardisation and harmonisation of survey activities in the field of economic analysis of the MNE.

If you have any further questions please contact me.

+49 345 7753-794 Request per E-MailResearch questions

The theory of technological accumulation and firm internationalisation proposes a dynamic relationship between locational technological advantages abroad, the internationalisation of firms’ technological activities, as well as the potential for technological spillovers to the domestic economy. The existing research on multinational enterprises (MNEs) in post communist transition economies of Central and East Europe focuses on locational determinants as well as host country effects. The results indicate that labour costs, market size, geographical proximity, and institutional factors do explain MNEs’ investment into the region. The role of technology related locational aspects has so far not been explored in depth. The empirical research on FDI effects on domestic firms’ productivity shows very mixed results. However, existing analyses consider the multinational enterprise not as an international network for the generation and diffusion of innovation but assume a unidirectional technology transfer perspective from the “West” to the “East”. From our point of view this is not only related to a lack of local absorptive capacity but can also be explained by the technological heterogeneity of MNEs. This view served as starting point for the research regarding MNEs in post-transition regions at the Halle Institute for Economic Research (IWH). The research addresses the following questions:

- What is the role of technology related locational advantages in the location choice of MNEs?

- To which extent do multinational affiliates implement technological activities (R&D, innovation) in comparison to the domestic economy?

- Which locational factors are decisive for the localisation of technological activities in multinational affiliates?

- To which extent are multinational affiliates’ technological activities connected with the domestic innovation system?

- Which role does technological heterogeneity in MNEs play for the potential of technology related knowledge spillovers to the domestic economy?

Data and Methods

Existing German enterprise level datasets (such as the German CIS data, or the IAB-Establishment data) do allow the identification of enterprises with foreign ownership. However, a representative sample of foreign or West German owned multinational affiliates based in East Germany is not available due to different sampling criteria being applied. The micro database of the German Central Bank (MiDi) registers enterprises with foreign participation only above a threshold of 3 million euros annual turnover and only at it's German regional ‘headquarter’. This leads to an underrepresentation of foreign multinational affiliates, in particular in case of the federal states within East Germany. Furthermore, this excellent source of financial data lacks firm level information on technological and other organisational issues. For selected Central and East European countries the situation is similar and an internationally harmonised and representative survey covering multinational affiliates’ in transition economies does not exist.

After a pilot survey in 2002, the IWH decided to start a primary data collection project on multinational affiliates based in transition economies. The survey ran from 2007 to 2013. An extended survey with a particular thematic focus was conducted in the odd years of 2007, 2009, 2011, 2013, whereas a short survey limited to structural indicators was carried out in 2008, 2010, and 2012. The survey took place on an annual basis amongst foreign and West German multinational affiliates based in East Germany. Furthermore, the extended version of the survey was conducted in additional selected transition economies of Central and East Europe. The pilot study in 2002 and the first extended version of the survey in 2007 were implemented in a decentralised way trough country teams. In 2009 the IWH switched to a centralised model. The first survey of 2007 was limited to manufacturing. Since 2008, affiliates in selected services had also been included. The survey covers internationally standardised structural indicators (on the basis of the Frascati and Oslo Manuals) and a range of information related to the MNE specific organisation of technological activities across borders and units. For a brief overview of the variables contained in the respective datasets you may have a look at this variable list (in German language). Additional information on the scope of the survey, the underlying population, and quality of the sample as well as survey method can be found in the respective questionnaire and methodological note for each annual round of the survey:

Data access

DOI: 10.18717/iwh.fdi3

Local access to the original survey data

The IWH provides external researchers with this data for non-commercial research purposes only. The data is formally anonymised and can be used at specific workplaces for guest researchers on IWH premises if a research interest is documented. Usage is granted upon application.

Please fill in the application form with your personal data and a detailed research proposal, which documents your research interest. Based on this information we will conclude a user contract. Please note our terms of use.

For further questions please contact: fdz@iwh-halle.de.

External access to Scientific-Use-Files

Since 2011 the Halle Institute for Economic Research (IWH) has been providing external access to the IWH FDI Micro Database via the Data Archive at the Leibniz Institute for Social Sciences (GESIS). Due to data protection regulations and in order to exclude the possibility of an identification of the participating enterprises, we can only offer external access to reduced versions of the original data (Scientific-Use-Files). In comparison to the original data, this dataset includes only information on inward FDI and no information on enterprises with outward FDI. In addition, selected variables such as the year of entry, type of investor, 4-digit industry code, employment, exports and intermediate inputs are only available in modestly transformed categories that still facilitate scientific analyses. The precise differences between the original data and its Scientific-Use-File are fully explained in the questionnaire of the corresponding study description.

The Data Archive GESIS offers all available data sets for a small fee. Using the StudyNo the data sets can be found in the GESIS-Data-Catalogue. By adding the desired data sets to the shopping the order is executed. The GESIS supplies the external users directly with the datasets after approval of the application. Please note that the Scientific-Use-Files cannot be supplied directly by the IWH.

| Survey | Country Range | Study Descriptions | Study No |

|---|---|---|---|

| 2013 | EG & CEE** | GER / ENG | ZA5940 |

| 2012 | EG* | GER / ENG | ZA5939 |

| 2011 | EG & CEE | GER / ENG | ZA5938 |

| 2010 | EG | GER / ENG | ZA5682 |

| 2009 | EG & CEE | GER / ENG | ZA5078 |

| 2008 | EG | GER / ENG | ZA5077 |

| 2007 | EG & CEE | GER / ENG | ZA5076 |

*East Germany; **Central and East Europe

Policy relevance

The research results based on the IWH FDI Micro Database feed an ongoing policy consultancy process at various levels with regard to areas such as investment, R&D, and innovation policy. For example, the Halle Institute for Economic Research (IWH) operated a workshop series jointly with “Germany Trade and Invest” as the federal agency in charge with foreign investment promotion in Germany. The target group of this workshop included regional promotion agencies as well as relevant policy experts at the federal level. At the international level the IWH consulted, for example, the Economic Ministry of the Republic of Azerbaijan with regard to the future investment policy. In addition, research results were used in consultations for the GD Regional Policy and GD Research of the European Commission. Finally, researchers presented the IWH FDI Micro Database as well as corresponding research results at international organisations such as UNCTAD („Symposium on International Investment for Development“) or the OECD („Global Forum on International Investment“).

Presentation and activities in relation to policy advise (selection from IWH research group)

A. Gauselmann: "Auswärtige Investoren in Ostdeutschland", Vortrag im Wirtschaftsministerium Sachsen-Anhalt, 17.09.2014

B. Jindra: "Die IWH-FDI-Mikrodatenbank - Entstehung, Stand und Perspektiven", 10th Bundesbank MiDi Workshop, Bundesbank in Frankfurt am Main, 8 November 2012

B. Jindra: „There is ultimately a data problem - Improving international standardization and coordination of IB surveys“, 3rd Reading conference on International Business: On the troubled relationship between theory and empirical evidence, University of Reading (UK), 10.- 11. 04. 2011

A. Gauselmann and B. Jindra: „Multinational Investors in East Germany", Presentation at the conference of Public Investment Promotion Agencies in the Federal State of Saxony,Aue (Germany), 15. March 2011

B. Jindra and M. Titze: „Investment promotion and the location of multinational firms“, Consultation with representatives of Germany Trade and Invest (GTaI), Halle, 3. February 2011

A. Gauselmann, J. Günther, B. Jindra, P. Marek: "Multinational Investors in East Germany", Presentation at the "Federal Ministry of the Interior, task force of the Beauftragten für die neuen Länder", Berlin, 26. January 2011

J. Günther and B. Jindra: Expert Talks on choice of location for foreign investors in East Germany at Germany Trade and Invest (GTal), the agency of the Federal Republic of Germany for foreign trade and location marketing, 14. July 2010

B. Jindra: „International standardisation of survey based micro data on international investment“, Symposium on International Investment for Development, United Nations Conference on Trade and Development (UNCTAD), Geneva, March 2010

„Understanding the relationship between knowledge and competitiveness in the enlarged European Union“, Final Project Conference, EU Commission, Brussels, February 2009

„Multinational Investors in East German HighTech-Sectors – Results of the IWH FDI Micro Database 2008“ German Federal Economic and Technology Ministry - Germany Trade and Invest, Berlin, March 2009

„Investment and FDI Policy for Azerbaijan- Presentation of Final Report”, Ministry for Economic Development of the Republic of Azerbaijan, Baku, November 2008

„Network Alignment and Industrial Policy“, Department of Economic Development and Tourism, Western Cape Provincial Government, Capetown (South Africa), October 2008

„Interaction of FDI and national innovation systems“, Global Forum on International Investment – Best Practise for Promoting Investment in Development, Organisation for Economic Co-operation and Development (OECD), Paris, March 2008

„Foreign Investors: How attractive is East Germany as a location for R&D and Innovation, Analyses und Policy for East Germany – Research of the IWH, Parliament of the Federal State of Saxony-Anhalt, Magdeburg, July 2008

„Global Integration and Local Capability as Determinants of R&D Sourcing in MNC subsidiaries - Evidence from five new EU member countries“, EU Commission - Joint Research Center, Sevilla, October 2007

„Global Integration and Local Capability as Determinants of R&D Sourcing in MNC subsidiaries - Evidence from five new EU member countries“, EU Commission GD Regional Policy, Brussels, March 2007

Further presentations for policy advise (without IWH participation)

„Scope and Some Elements of Foreign Direct Investment Policy“, presented by the Institute for Economic Research (IER) at the Vienna Institute for International Economic Studies – Economic Policy Seminar, Vienna, November 2009.

„R&D Activities as a Growth Factor of Foreign Owned SMEs in Croatia“, presented by the University of Zagreb at the EU Commission - Joint Research Center, Sevilla, October 2007

„Foreign subsidiaries in Croatian Manufacturing“, Trade and Investments Promotion Agency in Croatia, September 2007

„Scope and Some Elements of Foreign Direct Investment Policy", Seminar for Economic Policy in Romania organised by the Group of Applied Economists (GEA) and the Institute for Economic Research (IER), March 2007

External funding

EU projects

2012 – 2015 7th Framework Programme EU project: “Growth – Innovation – Competitiveness: Fostering Cohesion in Central and Eastern Europe” (GRINCOH), WP2: The International Context of Cohesion: The role of trade and FDI (in cooperation with UCL/UK, WIIW/Austria, IER/Slovenia, IE-HAS/Hungary).

2006 – 2009 6th Framework Program of the European Union: „Understanding the relationship between knowledge and competitiveness in the enlarging European Union“, Workpackage 1.2: „Knowledge transfer via Foreign Direct Investment (FDI)“; Workpackage 3.4: „Network Alignment“, Participants: Dr. J. Stephan, Dr. J. Günther und B. Jindra

2001- 2004 5th Framework Program of the European Union: „EU Integration and the Prospects for Catching-Up Development in Central Eastern European Countries - The Determinants of the Productivity Gap”, Workpackage: „Technology transfer via FDI, Participants: Dr. J. Stephan und B. Jindra

Other projects

2012 Project commissioned by the Expert Commission on Research and Innovation (EFI) (agency of the federal government): “International locations for R&D and innovation” (in cooperation with WU/Austria and DIW Berlin/Germany)

2012 7th Framework Programme Marie Curie Fellowship in the Marie Curie Initial Training Network (ITN) “Globalization, Investment, and Services Trade (GIST)” for Philipp Marek (IWH) at the University of Ljubljana (supervision Prof. Joze Damijan)

2008 GTZ Private Sector Development Program of the Ministry for Economics of the Republic of Azerbaijan: „Foreign Direct Investment Policy and Economic Development in the non-oil Sector“, Participants: Dr. J. Günther and B. Jindra

2005 – 2006 Ritsumeikan University (Japan): „A comparative Analysis of Japanese multinational affiliates in Central and East Europe“, Participants: Dr. J. Stephan and B. Jindra

Refereed doubled blind journals

Does Country Context Distance Determine Subsidiary Decision-making Autonomy? Theory and Evidence from European Transition Economies

in: International Business Review, No. 5, 2015

Abstract

We studied an underrepresented area in the international business (IB) literature: the effect of country context distance on the distribution of decision-making autonomy across headquarters and foreign affiliates. Foreign affiliates directly contribute to the competitive advantages of multinational enterprises, highlighting the importance of such intra-firm collaboration. The division of decision-making autonomy is a core issue in the management of headquarters–subsidiary relationships. The main contribution of our paper is that we confront two valid theoretical frameworks – business network theory and agency theory – that offer contradictory hypotheses with respect to the division of decision-making autonomy. Our study is among the first to examine this dilemma with a unique dataset from five Central and Eastern European transition countries. The empirical results provide convincing support for our approach to the study of subsidiary decision-making autonomy.

Agglomeration and FDI in East German Knowledge-intensive Business Services

in: Economia Politica, No. 3, 2012

Abstract

The focus of this article is the empirical identification of factors influencing Foreign Direct Investment (FDI) in the knowledge-intensive business service (KIBS) sector on the regional level of «Raumordnungsregionen» in East Germany. The analysis focuses on the impact of regional agglomeration and technological capability on the location decision of foreign investors and West German MNEs. It shows that localisation, patent activity and the share of employees with an R&D occupation affect significantly the location decision of FDI. This result provides an explanation for the strong concentration of KIBS in urban areas in a post-transition economy.

Regional Determinants of MNE’s Location Choice in Post-transition Economies

in: Empirica, No. 4, 2012

Abstract

This article focuses on the impact of agglomeration and labour market factors on the location choice of MNEs in post-transition economies. We compare data from 33 regions in East Germany, the Czech Republic and Poland using a mixed logit model on a sample of 4,343 subsidiaries for the time period between 2000 and 2010. The results show that agglomeration advantages, such as sectoral specialization as well as a region’s economic and technological performance prove to be some of the most important pull factors for FDI in post-transition regions.

Heterogeneous FDI in Transition Economies – A Novel Approach to Assess the Developmental Impact of Backward Linkages

in: World Development, No. 11, 2012

Abstract

Traditional models of technology transfer via FDI rely upon technology gap and absorptive capacity arguments to explain host economies’ potential to benefit from technological spillovers. This paper emphasizes foreign affiliates’ technological heterogeneity. We apply a novel approach differentiating extent and intensity of backward linkages between foreign affiliates and local suppliers. We use survey data on 809 foreign affiliates in five transition economies. Our evidence shows that foreign affiliates’ technological capability, embeddedness and autonomy are positively related to knowledge transfer via backward linkages. In contrast to what is widely assumed, we find a non-linear relationship between extent of local sourcing and knowledge transfer to domestic suppliers.

Challenging the Production Function Approach to Assess the Developmental Effects of FDI

in: European Journal of Development Research, No. 1, 2012

Abstract

From a theoretical point of view, it is traditionally assumed that foreign firms possess a centrally accumulated firm-specific technological advantage over domestic firms (see, for example, Findlay, 1978; Dunning, 1979). Given a sufficient level of absorptive capacity and human capital, domestic firms in host economies are able to benefit from various externalities stimulated by the presence of foreign firms.

An Introduction to the IWH FDI Micro Database

in: Schmollers Jahrbuch, No. 3, 2011

Abstract

Der Beitrag stellt die IWH-FDI-Mikrodatenbank vor. Er beschreibt die konzeptionellen Ideen der Datenbank und wie sich die Datenbank von anderen, existierenden Mikrodaten zu ausländischen Direktinvestitionen unterscheidet. Seit 2007 werden im Rahmen der IWH-FDI-Mikrodatenbank auf Unternehmensebene Informationen gesammelt zur allgemeinen Geschäftsentwicklung, zu technologischen Aktivitäten und zu Informationen über die konzerninternen Governancestrukturen. Die Daten werden bei den ausländischen Tochtergesellschaften multinationaler Unternehmen in Ostdeutschland und Osteuropa erhoben. Der Beitrag zeigt auf, welche Forschungslücken mit dem Datensatz bisher geschlossen wurden und schließt mit einem Ausblick bezüglich zukünftiger Forschungspotentiale.

What Drives FDI in Central-eastern Europe? Evidence from the IWH-FDI-Micro Database

in: Post-Communist Economies, No. 3, 2011

Abstract

The focus of this paper is on the match between strategic motives of foreign investments into Central-Eastern Europe and locational advantages offered by these countries. Our analysis makes use of the IWH-FDI-Micro Database, a unique dataset that contains information from 2009 about the determinants of locational factors, technological activity of the subsidiaries, and the potentials for knowledge spillovers in the Czech Republic, Hungary, Poland, Romania, and Slovakia. The analysis suggests that investors in these countries are mainly interested in low (unit) labour costs coupled with a well-trained and educated workforce and an expanding market with the high growth rates in the purchasing power of potential buyers. It also suggests that the financial crisis reduced the attractiveness of the region as a source for localised knowledge and technology. There appears to be a match between investors’ expectations and the quantitative supply of unqualified labour, not however for the supply of medium qualified workers. But the analysis suggests that it is not technology-seeking investments that are particularly content with the capabilities of their host economies in terms of technological cooperation. Finally, technological cooperation within the local host economy is assessed more favourably with domestic firms than with local scientific institutions – an important message for domestic economic policy.

Does Local Technology Matter for Foreign Investors in Central and Eastern Europe? Evidence from the IWH FDI Micro Database

in: Journal of East-West Business, No. 3, 2009

Abstract

Der Artikel betrachtet zum einen Investitionsmotive sowie das Ausmaß und die Intensität von technologischen Aktivitäten ausländischer Tochterunternehmen und zum anderen Faktoren, die einen Einfluss auf die technologische Anbindung der Tochterunternehmen an einheimische Wissenschaftseinrichtungen haben. Die Analyse bedient sich der IWH FDI Mikrodatenbank aus dem Jahre 2007, die Befragungsdaten von 809 ausländischen Tochterunternehmen in Mittel- und Osteuropa vorhält. Die Ergebnisse zeigen, dass ausländische Direktinvestitionen in die Region immer noch stark von Markt- und Effizienzmotiven getrieben werden. Die Suche nach lokal gebundenem Wissen, Kompetenzen und Technologie ist nachgeordnet. Allerdings betreibt die Mehrheit der ausländischen Tochterunternehmen sowohl Forschung und Entwicklung als auch Innovation. Jedoch setzen weitaus weniger Tochterunternehmen auf eine technologische Anbindung an einheimische Wissenschaftseinrichtungen.

Subsidiary Roles, Vertical Linkages and Economic Development: Lessons from Transition Economies

in: Journal of World Business, 2009

Abstract

Vertical supply chain linkages between foreign subsidiaries and domestic ?rms are important mechanisms for knowledge spillovers, contributing to the economic development of host economies. This paper argues that subsidiary roles and technological competences affect the extent of vertical linkages as such as well as their potential for technological spillovers. Using survey evidence from 424 foreign subsidiaries based in transition economies, we tested for the effect of subsidiaries’ autonomy, initiative, technological capability, internal and external technological embeddedness on the extent and intensity of forward and backward vertical linkages. The evidence supports our main argument that the potential of technology diffusion via vertical linkages depends on the nature of subsidiary roles. We discuss the implications for transition as well as other developing countries.

Ownership Structure, Strategic Controls and Export Intensity of Foreign-invested Firms in Transition Economies

in: Journal of International Business Studies, No. 7, 2008

Abstract

This paper examines the relationships between foreign ownership, managers’ independence in decision-making and exporting of foreign-invested firms in five European Union accession countries. Using a unique, hand-collected data set of 434 foreign-invested firms in Poland, Hungary, Slovenia, Slovakia and Estonia, we show that foreign investors’ ownership and control over strategic decisions are positively associated with export intensity, measured as the proportion of exports to total sales. The study also analyzes specific governance and control configurations in foreign-invested firms, showing that foreign equity and foreign control over business functions are complementary in terms of their effects on export intensity.

Foreign Subsidiaries in the East German Innovation System – Evidence from manufacturing industries

in: Applied Economics Quarterly Supplement, No. 59, 2008

Abstract

Die Veröffentlichung analysiert das Ausmaß technologischer Leistungsfähigkeit auf ausländische Tochtergesellschaften, welche in Ostdeutschland angesiedelt sind. Darüber hinaus betrachtet es Determinanten des technologischen Beschaffungsverhaltens ausländischer Tochtergesellschaften. Die Theorie der internationalen Produktion unterstreicht die Wichtigkeit von Variablen auf der strategischen und regionalen Ebene. Dennoch lassen existierende empirische Studien im Großen und Ganzen Faktoren auf regionaler Ebene aus. Wir entnehmen die Studienergebnisse aus der „ADI Mikrodatenbank“ des IWH, welche erst seit kurzem zur Verfügung steht, um die Analyse durchzuführen. Wir fanden heraus, dass ausländische Tochtergesellschaften im Vergleich zum gesamten verarbeitenden Gewerbe in Ostdeutschland überdurchschnittlich technologisch aktiv sind. Dies kann teilweise durch die industrielle Struktur der ausländischen Direktinvestitionen erklärt werden. Dennoch bezieht nur ein begrenzter Teil ausländischer Tochtergesellschaften mit F&E und/oder Innovationsaktivitäten technologisches Wissen aus dem ostdeutschen Innovationssystem. Wenn eine Tochtergesellschaft die Strategie der Kompetenzvermehrung verfolgt oder lokalen Handel betreibt, dann bezieht sie eher technologisches Wissen lokal. Die Ausstattung einer Region mit Humankapital und wissenschaftlicher Infrastruktur hat ebenfalls einen positiven Effekt. Diese Ergebnisse lassen schlussfolgern, dass ausländische Tochtergesellschaften in Ostdeutschland nur teilweise mit dem regionalen Innovationssystem verbunden sind. Strategien werden diskutiert.

The Role of the Human Capital and Managerial Skills in Explaining the Productivity Gaps between East and West

in: Eastern European Economics, No. 6, 2008

Abstract

Die Veröffentlichung beschäftigt sich mit den Determinanten von Produktivitätsgefällen zwischen Firmen in Europäischen Transitionsländern oder –regionen und Firmen in Westdeutschland. Die Analyse findet auf der Unternehmensebene statt und basiert auf einer einzigartigen Datenbank, welche durch Feldforschung erstellt worden ist. Die Determinanten werden in einer einfachen ökonometrischen Regression getestet und fokussieren auf Humankapital und modernes marktorientiertes Management. Die Ergebnisse sind insofern neu als sie eine Lösung anbieten, wie die widersprüchlichen Ergebnisse anderer Analysen zu formalen Qualifikationsmustern in Ost- und Westdeutschland zu erklären sind. Darüber hinaus ist es aufgrund der Analyse möglich eine Art Humankapital und Expertise zu entwickeln, welche meist in post-sozialistischen Firmen gebraucht wird und sich auf bestimmte Ansprüche an eine konkurrenzfähige marktbasierte ökonomische Umwelt bezieht. Letztendlich findet die Analyse auch empirische Beweise für die Rolle einer verbesserten Kapitalausstattung für den Produktivitätsausgleich sowie für das Argument, dass die Unterschiede in Arbeitsproduktivität bedeutend in einer größeren arbeitsintensiveren Produktion verwurzelt sind, was jedoch nicht zu einem wettbewerblichen Nachteil führt.

Knowledge Transfer to MNE Subsidiaries in Central and East Europe - Integrating Knowledge-based and Organisational Perspectives: An Introduction, Special Edition

in: East-West Journal of Economics and Business, 1 & 2 2005

read publication

Industry Level Technology Gaps and Complementary Knowledge Stocks as Determinants of Intra-MNC Knowledge Flows

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

Pursuing a subsidiary level analysis, we this paper tests the ‘technology gap’ hypothesis in the context of intra-MNC knowledge flows. Furthermore, it introduces complementary knowledge stocks into the concept of absorptive capacity. A set of hypotheses is tested in sample 434 foreign subsidiaries based in Central and East Europe. We find partial support for the ‘technology gap’ hypothesis applied at industry level. Furthermore, subsidiaries’ complementary knowledge stocks increase the probability for corresponding knowledge inflows from the foreign parent.

The Potentials for Technology Transfer via Foreign Direct Investement in Central and East Europe - Results of a Field Study

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

Foreign direct investment plays a particularly crucial role for the processes of technological catch-up in Central East Europe. Whilst most countries of this region have received considerable direct investments, the composition of kinds of subsidiaries is different between countries and hence will the prospects for intense technology transfer also differ between countries. This contribution aims to compare the potentials for internal and external technology transfer across countries of Central East Europe by analysing the management-relationship between subsidiaries and their parents and the market-relationships between subsidiaries and their host economy. For this, a firm-level database of some 458 subsidiaries in Estonia, Poland, the Slovak Republic, Hungary, and Slovenia is analysed empirically.

A strategy view on knowledge in the MNE – Integrating Subsidiary Roles and Knowledge Flows

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

We assume knowledge inflows endogenous to subsidiary roles. Integrating organisational and knowledge-based views we propose a new subsidiary typology based on MNE integration-subsidiary capability. We hypothesise that both dimensions are positively associated with knowledge inflows into the focal subsidiary. This prediction is tested with data for 425 subsidiaries. The key findings were: (a) the extent for knowledge inflows differs significantly across all subsidiary roles; (c) it diminishes in a anti-clockwise direction starting in the high integration-high capability quadrant of the IC taxonomy; thus (b) both MNE integration and subsidiary capability drive knowledge inflows, although, the balance shifts more towards integration.

Does Country Context Distance Determine Subsidiary Decision-making Autonomy? Theory and Evidence from European Transition Economies

in: International Business Review, No. 5, 2015

Abstract

We studied an underrepresented area in the international business (IB) literature: the effect of country context distance on the distribution of decision-making autonomy across headquarters and foreign affiliates. Foreign affiliates directly contribute to the competitive advantages of multinational enterprises, highlighting the importance of such intra-firm collaboration. The division of decision-making autonomy is a core issue in the management of headquarters–subsidiary relationships. The main contribution of our paper is that we confront two valid theoretical frameworks – business network theory and agency theory – that offer contradictory hypotheses with respect to the division of decision-making autonomy. Our study is among the first to examine this dilemma with a unique dataset from five Central and Eastern European transition countries. The empirical results provide convincing support for our approach to the study of subsidiary decision-making autonomy.

Agglomeration and FDI in East German Knowledge-intensive Business Services

in: Economia Politica, No. 3, 2012

Abstract

The focus of this article is the empirical identification of factors influencing Foreign Direct Investment (FDI) in the knowledge-intensive business service (KIBS) sector on the regional level of «Raumordnungsregionen» in East Germany. The analysis focuses on the impact of regional agglomeration and technological capability on the location decision of foreign investors and West German MNEs. It shows that localisation, patent activity and the share of employees with an R&D occupation affect significantly the location decision of FDI. This result provides an explanation for the strong concentration of KIBS in urban areas in a post-transition economy.

Regional Determinants of MNE’s Location Choice in Post-transition Economies

in: Empirica, No. 4, 2012

Abstract

This article focuses on the impact of agglomeration and labour market factors on the location choice of MNEs in post-transition economies. We compare data from 33 regions in East Germany, the Czech Republic and Poland using a mixed logit model on a sample of 4,343 subsidiaries for the time period between 2000 and 2010. The results show that agglomeration advantages, such as sectoral specialization as well as a region’s economic and technological performance prove to be some of the most important pull factors for FDI in post-transition regions.

Heterogeneous FDI in Transition Economies – A Novel Approach to Assess the Developmental Impact of Backward Linkages

in: World Development, No. 11, 2012

Abstract

Traditional models of technology transfer via FDI rely upon technology gap and absorptive capacity arguments to explain host economies’ potential to benefit from technological spillovers. This paper emphasizes foreign affiliates’ technological heterogeneity. We apply a novel approach differentiating extent and intensity of backward linkages between foreign affiliates and local suppliers. We use survey data on 809 foreign affiliates in five transition economies. Our evidence shows that foreign affiliates’ technological capability, embeddedness and autonomy are positively related to knowledge transfer via backward linkages. In contrast to what is widely assumed, we find a non-linear relationship between extent of local sourcing and knowledge transfer to domestic suppliers.

Challenging the Production Function Approach to Assess the Developmental Effects of FDI

in: European Journal of Development Research, No. 1, 2012

Abstract

From a theoretical point of view, it is traditionally assumed that foreign firms possess a centrally accumulated firm-specific technological advantage over domestic firms (see, for example, Findlay, 1978; Dunning, 1979). Given a sufficient level of absorptive capacity and human capital, domestic firms in host economies are able to benefit from various externalities stimulated by the presence of foreign firms.

An Introduction to the IWH FDI Micro Database

in: Schmollers Jahrbuch, No. 3, 2011

Abstract

Der Beitrag stellt die IWH-FDI-Mikrodatenbank vor. Er beschreibt die konzeptionellen Ideen der Datenbank und wie sich die Datenbank von anderen, existierenden Mikrodaten zu ausländischen Direktinvestitionen unterscheidet. Seit 2007 werden im Rahmen der IWH-FDI-Mikrodatenbank auf Unternehmensebene Informationen gesammelt zur allgemeinen Geschäftsentwicklung, zu technologischen Aktivitäten und zu Informationen über die konzerninternen Governancestrukturen. Die Daten werden bei den ausländischen Tochtergesellschaften multinationaler Unternehmen in Ostdeutschland und Osteuropa erhoben. Der Beitrag zeigt auf, welche Forschungslücken mit dem Datensatz bisher geschlossen wurden und schließt mit einem Ausblick bezüglich zukünftiger Forschungspotentiale.

What Drives FDI in Central-eastern Europe? Evidence from the IWH-FDI-Micro Database

in: Post-Communist Economies, No. 3, 2011

Abstract

The focus of this paper is on the match between strategic motives of foreign investments into Central-Eastern Europe and locational advantages offered by these countries. Our analysis makes use of the IWH-FDI-Micro Database, a unique dataset that contains information from 2009 about the determinants of locational factors, technological activity of the subsidiaries, and the potentials for knowledge spillovers in the Czech Republic, Hungary, Poland, Romania, and Slovakia. The analysis suggests that investors in these countries are mainly interested in low (unit) labour costs coupled with a well-trained and educated workforce and an expanding market with the high growth rates in the purchasing power of potential buyers. It also suggests that the financial crisis reduced the attractiveness of the region as a source for localised knowledge and technology. There appears to be a match between investors’ expectations and the quantitative supply of unqualified labour, not however for the supply of medium qualified workers. But the analysis suggests that it is not technology-seeking investments that are particularly content with the capabilities of their host economies in terms of technological cooperation. Finally, technological cooperation within the local host economy is assessed more favourably with domestic firms than with local scientific institutions – an important message for domestic economic policy.

Does Local Technology Matter for Foreign Investors in Central and Eastern Europe? Evidence from the IWH FDI Micro Database

in: Journal of East-West Business, No. 3, 2009

Abstract

Der Artikel betrachtet zum einen Investitionsmotive sowie das Ausmaß und die Intensität von technologischen Aktivitäten ausländischer Tochterunternehmen und zum anderen Faktoren, die einen Einfluss auf die technologische Anbindung der Tochterunternehmen an einheimische Wissenschaftseinrichtungen haben. Die Analyse bedient sich der IWH FDI Mikrodatenbank aus dem Jahre 2007, die Befragungsdaten von 809 ausländischen Tochterunternehmen in Mittel- und Osteuropa vorhält. Die Ergebnisse zeigen, dass ausländische Direktinvestitionen in die Region immer noch stark von Markt- und Effizienzmotiven getrieben werden. Die Suche nach lokal gebundenem Wissen, Kompetenzen und Technologie ist nachgeordnet. Allerdings betreibt die Mehrheit der ausländischen Tochterunternehmen sowohl Forschung und Entwicklung als auch Innovation. Jedoch setzen weitaus weniger Tochterunternehmen auf eine technologische Anbindung an einheimische Wissenschaftseinrichtungen.

Subsidiary Roles, Vertical Linkages and Economic Development: Lessons from Transition Economies

in: Journal of World Business, 2009

Abstract

Vertical supply chain linkages between foreign subsidiaries and domestic ?rms are important mechanisms for knowledge spillovers, contributing to the economic development of host economies. This paper argues that subsidiary roles and technological competences affect the extent of vertical linkages as such as well as their potential for technological spillovers. Using survey evidence from 424 foreign subsidiaries based in transition economies, we tested for the effect of subsidiaries’ autonomy, initiative, technological capability, internal and external technological embeddedness on the extent and intensity of forward and backward vertical linkages. The evidence supports our main argument that the potential of technology diffusion via vertical linkages depends on the nature of subsidiary roles. We discuss the implications for transition as well as other developing countries.

Ownership Structure, Strategic Controls and Export Intensity of Foreign-invested Firms in Transition Economies

in: Journal of International Business Studies, No. 7, 2008

Abstract

This paper examines the relationships between foreign ownership, managers’ independence in decision-making and exporting of foreign-invested firms in five European Union accession countries. Using a unique, hand-collected data set of 434 foreign-invested firms in Poland, Hungary, Slovenia, Slovakia and Estonia, we show that foreign investors’ ownership and control over strategic decisions are positively associated with export intensity, measured as the proportion of exports to total sales. The study also analyzes specific governance and control configurations in foreign-invested firms, showing that foreign equity and foreign control over business functions are complementary in terms of their effects on export intensity.

Foreign Subsidiaries in the East German Innovation System – Evidence from manufacturing industries

in: Applied Economics Quarterly Supplement, No. 59, 2008

Abstract

Die Veröffentlichung analysiert das Ausmaß technologischer Leistungsfähigkeit auf ausländische Tochtergesellschaften, welche in Ostdeutschland angesiedelt sind. Darüber hinaus betrachtet es Determinanten des technologischen Beschaffungsverhaltens ausländischer Tochtergesellschaften. Die Theorie der internationalen Produktion unterstreicht die Wichtigkeit von Variablen auf der strategischen und regionalen Ebene. Dennoch lassen existierende empirische Studien im Großen und Ganzen Faktoren auf regionaler Ebene aus. Wir entnehmen die Studienergebnisse aus der „ADI Mikrodatenbank“ des IWH, welche erst seit kurzem zur Verfügung steht, um die Analyse durchzuführen. Wir fanden heraus, dass ausländische Tochtergesellschaften im Vergleich zum gesamten verarbeitenden Gewerbe in Ostdeutschland überdurchschnittlich technologisch aktiv sind. Dies kann teilweise durch die industrielle Struktur der ausländischen Direktinvestitionen erklärt werden. Dennoch bezieht nur ein begrenzter Teil ausländischer Tochtergesellschaften mit F&E und/oder Innovationsaktivitäten technologisches Wissen aus dem ostdeutschen Innovationssystem. Wenn eine Tochtergesellschaft die Strategie der Kompetenzvermehrung verfolgt oder lokalen Handel betreibt, dann bezieht sie eher technologisches Wissen lokal. Die Ausstattung einer Region mit Humankapital und wissenschaftlicher Infrastruktur hat ebenfalls einen positiven Effekt. Diese Ergebnisse lassen schlussfolgern, dass ausländische Tochtergesellschaften in Ostdeutschland nur teilweise mit dem regionalen Innovationssystem verbunden sind. Strategien werden diskutiert.

The Role of the Human Capital and Managerial Skills in Explaining the Productivity Gaps between East and West

in: Eastern European Economics, No. 6, 2008

Abstract

Die Veröffentlichung beschäftigt sich mit den Determinanten von Produktivitätsgefällen zwischen Firmen in Europäischen Transitionsländern oder –regionen und Firmen in Westdeutschland. Die Analyse findet auf der Unternehmensebene statt und basiert auf einer einzigartigen Datenbank, welche durch Feldforschung erstellt worden ist. Die Determinanten werden in einer einfachen ökonometrischen Regression getestet und fokussieren auf Humankapital und modernes marktorientiertes Management. Die Ergebnisse sind insofern neu als sie eine Lösung anbieten, wie die widersprüchlichen Ergebnisse anderer Analysen zu formalen Qualifikationsmustern in Ost- und Westdeutschland zu erklären sind. Darüber hinaus ist es aufgrund der Analyse möglich eine Art Humankapital und Expertise zu entwickeln, welche meist in post-sozialistischen Firmen gebraucht wird und sich auf bestimmte Ansprüche an eine konkurrenzfähige marktbasierte ökonomische Umwelt bezieht. Letztendlich findet die Analyse auch empirische Beweise für die Rolle einer verbesserten Kapitalausstattung für den Produktivitätsausgleich sowie für das Argument, dass die Unterschiede in Arbeitsproduktivität bedeutend in einer größeren arbeitsintensiveren Produktion verwurzelt sind, was jedoch nicht zu einem wettbewerblichen Nachteil führt.

Knowledge Transfer to MNE Subsidiaries in Central and East Europe - Integrating Knowledge-based and Organisational Perspectives: An Introduction, Special Edition

in: East-West Journal of Economics and Business, 1 & 2 2005

read publication

Industry Level Technology Gaps and Complementary Knowledge Stocks as Determinants of Intra-MNC Knowledge Flows

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

Pursuing a subsidiary level analysis, we this paper tests the ‘technology gap’ hypothesis in the context of intra-MNC knowledge flows. Furthermore, it introduces complementary knowledge stocks into the concept of absorptive capacity. A set of hypotheses is tested in sample 434 foreign subsidiaries based in Central and East Europe. We find partial support for the ‘technology gap’ hypothesis applied at industry level. Furthermore, subsidiaries’ complementary knowledge stocks increase the probability for corresponding knowledge inflows from the foreign parent.

The Potentials for Technology Transfer via Foreign Direct Investement in Central and East Europe - Results of a Field Study

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

Foreign direct investment plays a particularly crucial role for the processes of technological catch-up in Central East Europe. Whilst most countries of this region have received considerable direct investments, the composition of kinds of subsidiaries is different between countries and hence will the prospects for intense technology transfer also differ between countries. This contribution aims to compare the potentials for internal and external technology transfer across countries of Central East Europe by analysing the management-relationship between subsidiaries and their parents and the market-relationships between subsidiaries and their host economy. For this, a firm-level database of some 458 subsidiaries in Estonia, Poland, the Slovak Republic, Hungary, and Slovenia is analysed empirically.

A strategy view on knowledge in the MNE – Integrating Subsidiary Roles and Knowledge Flows

in: East-West Journal of Economics and Business, 1 & 2 2005

Abstract

We assume knowledge inflows endogenous to subsidiary roles. Integrating organisational and knowledge-based views we propose a new subsidiary typology based on MNE integration-subsidiary capability. We hypothesise that both dimensions are positively associated with knowledge inflows into the focal subsidiary. This prediction is tested with data for 425 subsidiaries. The key findings were: (a) the extent for knowledge inflows differs significantly across all subsidiary roles; (c) it diminishes in a anti-clockwise direction starting in the high integration-high capability quadrant of the IC taxonomy; thus (b) both MNE integration and subsidiary capability drive knowledge inflows, although, the balance shifts more towards integration.

Articles in “Wirtschaft im Wandel”

Knowledge complementarity and productivity growth within foreign subsidiaries in Central and Eastern Europe

in: Wirtschaft im Wandel, No. 3, 2006

Abstract

Multinationale Unternehmen haben sich in Mittelund Osteuropa angesiedelt, um zum einen am Markt präsent zu sein und zum anderen den Standort als Basis für den internationalen Handel zu nutzen. Marktpräsenz hat sich als Motiv für Neuansiedlungen weitestgehend erschöpft. Zeitgleich konkurriert Mittel- und Osteuropa verstärkt mit asiatischen Ökonomien als Produktionsstandort. Die Ressource Wissen stellt ein zusätzliches entscheidendes Motiv für Investitionen dar. Multinationale Unternehmen übertragen spezifisches Wissen an einen anderen Unternehmensteil, damit dieser seine Funktion innerhalb des Konzerns erfüllen kann. Der effiziente Transfer kann durch die Beschaffenheit des Wissens, geographische und sprachliche Barrieren aber auch durch unzureichende absorptive Kapazität im Tochterunternehmen behindert werden. D. h., Tochterunternehmen müssen komplementäres Wissen und Fähigkeiten besitzen, um das externe Wissen produktiv absorbieren zu können. Der vorliegende Beitrag untersucht anhand eines Mikrodatensatzes in fünf EU-Beitrittsländern den Zusammenhang zwischen komplementärem Wissen und Produktivitätswachstum. Es kann festgestellt werde, daß ausländische Tochterbetriebe von direktem Wissenstransfer profitieren und lokales Wissen ebenfalls einen positiven Effekt auf das Produktivitätswachstum hat. Es werden zwei dominierende Typen der Wissenskomplementarität identifiziert. Bei Typ (I) transferiert der ausländische Investor technologisches Kernwissen und das Tochterunternehmen besitzt komplementäres Wissen in der Anwendung. Bei Typ (II) ist technologisches Kernwissen auf Mutter- und Tochterunternehmen komplementär verteilt. Aus der Forschung kann geschlußfolgert werden, daß es für die Länder Mittel- und Osteuropas von Bedeutung ist, die Humankapitalbasis ausreichend zu entwickeln, um in Zukunft nicht vom technologischen Wissenstransfer durch ausländische Investitionen ausgeschlossen zu werden.

Under which conditions do inland suppliers profit from foreign direct investment?

in: Wirtschaft im Wandel, No. 10, 2006

Abstract

Aus theoretischer Sicht ergeben sich durch die Präsenz ausländischer Unternehmen nicht nur realwirtschaftliche Effekte auf Produktion und Beschäftigung, sondern auch ein Potential für technologische Entwicklung durch Wissenstransfer zu einheimischen Unternehmen. Dieser Wissenstransfer ist abhängig von dem Grad der Verflechtung des ausländischen Unternehmens mit der einheimischen Wirtschaft. Dabei kommt der Beziehung zwischen Investor und einheimischen Zulieferunternehmen eine zentrale Bedeutung zu, denn multinationale Unternehmen haben ein strategisches Interesse, alle lokalen Effizienzvorteile auszuschöpfen. Der vorliegende Beitrag unterstellt, daß sowohl die Ausbildung von Zulieferbeziehungen als auch das Potential für Wissenstransfer zum einen von organisatorischen Faktoren im ausländischen Unternehmen und zum anderen von der lokalen Wissensbasis und der technologischen Leistungsfähigkeit abhängig sind. Dieser Zusammenhang wird an Hand eines Datensatzes von 434 Tochterunternehmen aus fünf Mittel- und Osteuropäischen Ländern getestet. Die Ergebnisse zeigen, daß die Intensität von Zulieferbeziehungen als auch das Potential für Wissenstransfer steigt, wenn Tochterunternehmen als Joint Venture geführt werden sowie Eigenverantwortung in den Bereichen Logistik und Zulieferung besitzen. Die technologische Leistungsfähigkeit des heimischen Sektors fördert sowohl die Intensität von Zulieferbeziehungen als auch das Potential für Wissenstransfer. Zusätzlich steigert die absorptive Kapazität der einheimischen Zulieferbetriebe das Potential für Wissenstransfer. Will man verhindern, daß ausländische Investitionen auf einer „Insel“ inmitten der einheimischen Wirtschaft operieren und keine Wissenseffekte generieren, dann bietet die Förderung von Forschungs- und Entwicklungskooperationen zwischen ausländischen Investoren und lokalen Zulieferbetrieben in technologisch leistungsfähigen Sektoren ein opportunes Mittel.

East German Innovation System attractive for Foreign Investors

in: Wirtschaft im Wandel, No. 1, 2008

Abstract

Ausländische Direktinvestitionen gelten als wichtige Impulsgeber für den wirtschaftlichen Aufholprozeß in Ostdeutschland. Dabei stellen die von ausländischen Investoren erhofften Beschäftigungs- und Nachfrageeffekte weiterhin eine wichtige Zielmarke dar. Vor dem Hintergrund des zunehmenden internationalen Standortwettbewerbs sollte aber auch ihrem Beitrag zur technologischen Leistungsfähigkeit im ostdeutschen Innovationssystem Aufmerksamkeit geschenkt werden. In der bisherigen Diskussion ist dem ostdeutschen Standort diesbezüglich wenig Potential bescheinigt worden. Belastbare empirische Befunde dafür fehlen bisher jedoch. Der vorliegende Beitrag geht daher der Frage nach, ob und inwiefern ausländische Investoren am ostdeutschen Standort technologische Aktivitäten (FuE und Innovation) durchführen und ob diese in das ostdeutsche Innovationssystem integriert sind, das heißt mit lokalen Akteuren (Unternehmen und Wissenschaftseinrichtungen) interagieren. Grundlage der empirischen Untersuchung ist eine aktuelle repräsentative Befragung ausländischer Investoren im Verarbeitenden Gewerbe Ostdeutschlands. Die empirische Untersuchung zeigt, daß sich die ausländischen Investoren im Vergleich zum gesamten Verarbeitenden Gewerbe durch eine höhere technologische Aktivität (gemessen an FuE und Innovation) auszeichnen und mit diesen Aktivitäten keineswegs isolierte Inseln bilden, sondern klar in das ostdeutsche Innovationssystem eingebettet sind. Ausländische Investoren messen dabei besonders den ostdeutschen Wissenschaftseinrichtungen Bedeutung bei. Untersucht man die Integration der Investoren in Abhängigkeit von ihrer technologischen Leistungsfähigkeit, zeigt sich im Einklang mit der theoretischen Literatur, daß es gerade die technologisch leistungsfähigen Investoren sind, die den Austausch mit lokalen Akteuren suchen. Dabei ist jedoch im Hinblick auf mögliche Spillover-Effekte zugunsten einheimischer Unternehmen festzustellen, daß lediglich Zulieferer als potentielle Adressaten firmieren. Entgegen existierenden Annahmen kann dem ostdeutschen Innovationssystem also bescheinigt werden, daß es für ausländische Investoren mit FuE- und Innovationsaktivitäten durchaus attraktiv ist und damit im Vergleich zu ostmitteleuropäischen und asiatischen Aufhol-Ländern Standortvorteile zu bieten hat.

Aktuelle Trends: Überraschend stabile Geschäftsaussichten auswärtiger Investoren in Ostdeutschland für das Jahr 2009

in: Wirtschaft im Wandel, No. 2, 2009

Abstract

Zwischen dem 16. Oktober und 10. Dezember 2008 hat das IWH 657 Tochtergesellschaften ausländischer und westdeutscher multinationaler Investoren mit Sitz in den Neuen Bundesländern zu den Erwartungen für das Geschäftsjahr 2009 befragt. Diese Unternehmen haben in der ostdeutschen Wirtschaft ein erhebliches Gewicht, so arbeitet z. B. jeder vierte Arbeitnehmer im Verarbeitenden Gewerbe für ein Unternehmen mit auswärtigen Investoren.

Globalisierung von Forschung und Entwicklung – der Technologiestandort Deutschland

in: Wirtschaft im Wandel, No. 2, 2009

Abstract

Am 11. November 2008 fand am Institut für Wirtschaftsforschung Halle (IWH) zum zweiten Mal ein innovationspolitischer Workshop statt, diesmal zum Thema „Globalisierung von Forschung und Entwicklung – der Technologiestandort Deutschland“. Die Veranstaltung bildete zugleich einen Bestandteil des vom IWH koordinierten EU-Projekts U-Know („Understanding the Relationship between Knowledge and Competitiveness in the Enlarging EU“), das sich mit einer Reihe innovationsökonomischer Forschungsthemen beschäftigt. Der Workshop hatte zum Ziel, das Thema Globalisierung von Forschung und Entwicklung aus wissenschaftlicher, unternehmerischer und innovationspolitischer Perspektive zu beleuchten und die Position Deutschlands im internationalen Technologiewettbewerb zu diskutieren.

Aktuelle Trends: Gemeinsam statt einsam: Forschungskooperationen auswärtiger Investoren in Ostdeutschland

in: Wirtschaft im Wandel, No. 5, 2009

Abstract

Auswärtige Investoren, das heißt Tochtergesellschaften ausländischer und westdeutscher multinationaler Unternehmen mit Sitz in den Neuen Bundesländern (NBL), bilden mit ca. 3 500 Gesellschaften und über 500 000 Beschäftigten im Produzierenden Gewerbe und in ausgewählten Dienstleistungsbranchen einen wichtigen Bestandteil der ostdeutschen Wirtschaft (einschließlich Berlin). Nicht selten finden sich in dieser Gruppe große und technologieorientierte Unternehmen mit strukturbestimmendem Charakter. Das IWH befragt diese Unternehmen daher jährlich insbesondere zu ihren Forschungs- und Entwicklungsaktivitäten.

Aktuelle Trends: Motive auswärtiger Investoren für die Wahl des Standortes in Ostdeutschland

in: Wirtschaft im Wandel, No. 4, 2010

Abstract

Das IWH hat mit der dritten Welle der FDI-Mikrodatenbank im Herbst 2009 eine Befragung von ostdeutschen Unternehmen mit ausländischem und/oder westdeutschem multinationalem Investor durchgeführt. Dabei beantworteten die Unternehmen u. a. die Frage nach den strategischen Investitionsmotiven ihres ausländischen und/oder westdeutschen multinationalen Gesellschafters für die Neugründung eines Tochterunternehmens bzw. für die Beteiligung an einem bereits existierenden Unternehmen in den Neuen Bundesländern.

The Attractiveness of East Germany as Investment Location for Multinational Enterprises (MNEs)

in: Wirtschaft im Wandel, No. 6, 2010

Abstract

Der vorliegende Beitrag betrachtet zum einen die grundlegenden Investitionsmotive multinationaler Investoren in Ostdeutschland. Zum anderen wird untersucht, wie diese Investoren die Qualität ausgewählter Standortfaktoren in den Neuen Ländern bewerten. Im Gegensatz zu bisherigen Studien wird die Heterogenität multinationaler Unternehmen in der Analyse eingehend berücksichtigt. Die Untersuchung basiert auf der dritten Befragungswelle der IWH-FDI-Mikrodatenbank aus dem Jahr 2009, die eine repräsentative und umfangreiche Stichprobe multinationaler Investoren in der ostdeutschen Wirtschaft bietet. Die Ergebnisse belegen einen Paradigmenwechsel in der relativen Bedeutung grundlegender Investitionsmotive im Laufe der Transformation in den Neuen Ländern. Seit Mitte der 1990er Jahre ziehen sie verstärkt Investoren an, die auf die Produktdiversifikation oder technologische Vorteile abzielen, statt primär auf Kostenvorteile bei den Produktionsfaktoren oder die Ausdehnung ihrer bestehenden Produktion zu setzen. Dabei unterscheidet sich die Bedeutung der Investitionsmotive in Abhängigkeit vom Herkunftsland, der Art des Markteintritts und dem Wirtschaftszweig des multinationalen Investors. Was die Bewertung der gegebenen Standortfaktoren aus Sicht der Investoren betrifft, so schneidet die Qualität des soziokulturellen Umfelds am besten ab, gefolgt von Faktoren im Zusammenhang mit dem Potenzial für technologische Kooperationen, dem Angebot an Arbeitskräften sowie der Verfügbarkeit staatlicher Förderung. Auch in der Bewertung der Standortfaktoren zeigt sich, dass signifikante Unterschiede in Abhängigkeit vom Herkunftsland, aber auch je nach dem vorrangigen Investitionsmotiv des Investors bestehen. Abschließend identifiziert der Beitrag politischen Handlungsbedarf auf den Feldern Fachkräfteangebot sowie Technologie- und Investitionsförderung, um den Wirtschaftsstandort Neue Länder nachhaltig zu sichern.

Aktuelle Trends: Auswärtige Investoren in Ostdeutschland blicken zuversichtlich in das Jahr 2011

in: Wirtschaft im Wandel, No. 1, 2011

Abstract

Seit dem Jahr 2007 führt das IWH regelmäßig Befragungen auswärtiger Investoren in Ostdeutschland durch. In der Zeit von September bis Oktober 2010 hat das IWH 614 Tochtergesellschaften ausländischer und westdeutscher multinationaler Investoren mit Sitz in Ostdeutschland (einschließlich Berlin) zu ihren Erwartungen für das Geschäftsjahr 2011 befragt. Die Gruppe der befragten Unternehmen umfasst das Produzierende Gewerbe und ausgewählte Bereiche des Dienstleistungssektors. Diese Unternehmen haben in der ostdeutschen Wirtschaft ein erhebliches Gewicht. So arbeitet beispielsweise jeder vierte Arbeitsnehmer im Verarbeitenden Gewerbe in einem Unternehmen mit auswärtigem Investor.

Aktuelle Trends: Multinationale Investoren in Ostdeutschland erwarten keine Eintrübung der Geschäftsaussichten im Jahr 2013

in: Wirtschaft im Wandel, No. 1, 2013

Abstract

Das IWH führt in Ostdeutschland (inklusive Berlin) seit dem Jahr 2007 regelmäßig Befragungen von Tochterunternehmen multinationaler Konzerne mit Hauptsitz im Ausland bzw. in den westdeutschen Bundesländern durch. Im September 2012 wurden insgesamt 466 Tochterunternehmen bezüglich ihrer Geschäftserwartungen für das Jahr 2013 befragt. Die befragten Unternehmen gehören entweder dem Verarbeitenden Gewerbe oder ausgewählten Dienstleistungssektoren an. Ihr Gewicht in der ostdeutschen Wirtschaft ist erheblich: Beispielsweise ist jeder vierte Arbeitnehmer im Verarbeitenden Gewerbe bei einem Tochterunternehmen mit multinationalem Investor beschäftigt.

Knowledge complementarity and productivity growth within foreign subsidiaries in Central and Eastern Europe

in: Wirtschaft im Wandel, No. 3, 2006

Abstract

Multinationale Unternehmen haben sich in Mittelund Osteuropa angesiedelt, um zum einen am Markt präsent zu sein und zum anderen den Standort als Basis für den internationalen Handel zu nutzen. Marktpräsenz hat sich als Motiv für Neuansiedlungen weitestgehend erschöpft. Zeitgleich konkurriert Mittel- und Osteuropa verstärkt mit asiatischen Ökonomien als Produktionsstandort. Die Ressource Wissen stellt ein zusätzliches entscheidendes Motiv für Investitionen dar. Multinationale Unternehmen übertragen spezifisches Wissen an einen anderen Unternehmensteil, damit dieser seine Funktion innerhalb des Konzerns erfüllen kann. Der effiziente Transfer kann durch die Beschaffenheit des Wissens, geographische und sprachliche Barrieren aber auch durch unzureichende absorptive Kapazität im Tochterunternehmen behindert werden. D. h., Tochterunternehmen müssen komplementäres Wissen und Fähigkeiten besitzen, um das externe Wissen produktiv absorbieren zu können. Der vorliegende Beitrag untersucht anhand eines Mikrodatensatzes in fünf EU-Beitrittsländern den Zusammenhang zwischen komplementärem Wissen und Produktivitätswachstum. Es kann festgestellt werde, daß ausländische Tochterbetriebe von direktem Wissenstransfer profitieren und lokales Wissen ebenfalls einen positiven Effekt auf das Produktivitätswachstum hat. Es werden zwei dominierende Typen der Wissenskomplementarität identifiziert. Bei Typ (I) transferiert der ausländische Investor technologisches Kernwissen und das Tochterunternehmen besitzt komplementäres Wissen in der Anwendung. Bei Typ (II) ist technologisches Kernwissen auf Mutter- und Tochterunternehmen komplementär verteilt. Aus der Forschung kann geschlußfolgert werden, daß es für die Länder Mittel- und Osteuropas von Bedeutung ist, die Humankapitalbasis ausreichend zu entwickeln, um in Zukunft nicht vom technologischen Wissenstransfer durch ausländische Investitionen ausgeschlossen zu werden.

Under which conditions do inland suppliers profit from foreign direct investment?

in: Wirtschaft im Wandel, No. 10, 2006

Abstract

Aus theoretischer Sicht ergeben sich durch die Präsenz ausländischer Unternehmen nicht nur realwirtschaftliche Effekte auf Produktion und Beschäftigung, sondern auch ein Potential für technologische Entwicklung durch Wissenstransfer zu einheimischen Unternehmen. Dieser Wissenstransfer ist abhängig von dem Grad der Verflechtung des ausländischen Unternehmens mit der einheimischen Wirtschaft. Dabei kommt der Beziehung zwischen Investor und einheimischen Zulieferunternehmen eine zentrale Bedeutung zu, denn multinationale Unternehmen haben ein strategisches Interesse, alle lokalen Effizienzvorteile auszuschöpfen. Der vorliegende Beitrag unterstellt, daß sowohl die Ausbildung von Zulieferbeziehungen als auch das Potential für Wissenstransfer zum einen von organisatorischen Faktoren im ausländischen Unternehmen und zum anderen von der lokalen Wissensbasis und der technologischen Leistungsfähigkeit abhängig sind. Dieser Zusammenhang wird an Hand eines Datensatzes von 434 Tochterunternehmen aus fünf Mittel- und Osteuropäischen Ländern getestet. Die Ergebnisse zeigen, daß die Intensität von Zulieferbeziehungen als auch das Potential für Wissenstransfer steigt, wenn Tochterunternehmen als Joint Venture geführt werden sowie Eigenverantwortung in den Bereichen Logistik und Zulieferung besitzen. Die technologische Leistungsfähigkeit des heimischen Sektors fördert sowohl die Intensität von Zulieferbeziehungen als auch das Potential für Wissenstransfer. Zusätzlich steigert die absorptive Kapazität der einheimischen Zulieferbetriebe das Potential für Wissenstransfer. Will man verhindern, daß ausländische Investitionen auf einer „Insel“ inmitten der einheimischen Wirtschaft operieren und keine Wissenseffekte generieren, dann bietet die Förderung von Forschungs- und Entwicklungskooperationen zwischen ausländischen Investoren und lokalen Zulieferbetrieben in technologisch leistungsfähigen Sektoren ein opportunes Mittel.

East German Innovation System attractive for Foreign Investors

in: Wirtschaft im Wandel, No. 1, 2008

Abstract

Ausländische Direktinvestitionen gelten als wichtige Impulsgeber für den wirtschaftlichen Aufholprozeß in Ostdeutschland. Dabei stellen die von ausländischen Investoren erhofften Beschäftigungs- und Nachfrageeffekte weiterhin eine wichtige Zielmarke dar. Vor dem Hintergrund des zunehmenden internationalen Standortwettbewerbs sollte aber auch ihrem Beitrag zur technologischen Leistungsfähigkeit im ostdeutschen Innovationssystem Aufmerksamkeit geschenkt werden. In der bisherigen Diskussion ist dem ostdeutschen Standort diesbezüglich wenig Potential bescheinigt worden. Belastbare empirische Befunde dafür fehlen bisher jedoch. Der vorliegende Beitrag geht daher der Frage nach, ob und inwiefern ausländische Investoren am ostdeutschen Standort technologische Aktivitäten (FuE und Innovation) durchführen und ob diese in das ostdeutsche Innovationssystem integriert sind, das heißt mit lokalen Akteuren (Unternehmen und Wissenschaftseinrichtungen) interagieren. Grundlage der empirischen Untersuchung ist eine aktuelle repräsentative Befragung ausländischer Investoren im Verarbeitenden Gewerbe Ostdeutschlands. Die empirische Untersuchung zeigt, daß sich die ausländischen Investoren im Vergleich zum gesamten Verarbeitenden Gewerbe durch eine höhere technologische Aktivität (gemessen an FuE und Innovation) auszeichnen und mit diesen Aktivitäten keineswegs isolierte Inseln bilden, sondern klar in das ostdeutsche Innovationssystem eingebettet sind. Ausländische Investoren messen dabei besonders den ostdeutschen Wissenschaftseinrichtungen Bedeutung bei. Untersucht man die Integration der Investoren in Abhängigkeit von ihrer technologischen Leistungsfähigkeit, zeigt sich im Einklang mit der theoretischen Literatur, daß es gerade die technologisch leistungsfähigen Investoren sind, die den Austausch mit lokalen Akteuren suchen. Dabei ist jedoch im Hinblick auf mögliche Spillover-Effekte zugunsten einheimischer Unternehmen festzustellen, daß lediglich Zulieferer als potentielle Adressaten firmieren. Entgegen existierenden Annahmen kann dem ostdeutschen Innovationssystem also bescheinigt werden, daß es für ausländische Investoren mit FuE- und Innovationsaktivitäten durchaus attraktiv ist und damit im Vergleich zu ostmitteleuropäischen und asiatischen Aufhol-Ländern Standortvorteile zu bieten hat.

Aktuelle Trends: Überraschend stabile Geschäftsaussichten auswärtiger Investoren in Ostdeutschland für das Jahr 2009

in: Wirtschaft im Wandel, No. 2, 2009

Abstract

Zwischen dem 16. Oktober und 10. Dezember 2008 hat das IWH 657 Tochtergesellschaften ausländischer und westdeutscher multinationaler Investoren mit Sitz in den Neuen Bundesländern zu den Erwartungen für das Geschäftsjahr 2009 befragt. Diese Unternehmen haben in der ostdeutschen Wirtschaft ein erhebliches Gewicht, so arbeitet z. B. jeder vierte Arbeitnehmer im Verarbeitenden Gewerbe für ein Unternehmen mit auswärtigen Investoren.

Globalisierung von Forschung und Entwicklung – der Technologiestandort Deutschland

in: Wirtschaft im Wandel, No. 2, 2009

Abstract

Am 11. November 2008 fand am Institut für Wirtschaftsforschung Halle (IWH) zum zweiten Mal ein innovationspolitischer Workshop statt, diesmal zum Thema „Globalisierung von Forschung und Entwicklung – der Technologiestandort Deutschland“. Die Veranstaltung bildete zugleich einen Bestandteil des vom IWH koordinierten EU-Projekts U-Know („Understanding the Relationship between Knowledge and Competitiveness in the Enlarging EU“), das sich mit einer Reihe innovationsökonomischer Forschungsthemen beschäftigt. Der Workshop hatte zum Ziel, das Thema Globalisierung von Forschung und Entwicklung aus wissenschaftlicher, unternehmerischer und innovationspolitischer Perspektive zu beleuchten und die Position Deutschlands im internationalen Technologiewettbewerb zu diskutieren.

Aktuelle Trends: Gemeinsam statt einsam: Forschungskooperationen auswärtiger Investoren in Ostdeutschland

in: Wirtschaft im Wandel, No. 5, 2009

Abstract

Auswärtige Investoren, das heißt Tochtergesellschaften ausländischer und westdeutscher multinationaler Unternehmen mit Sitz in den Neuen Bundesländern (NBL), bilden mit ca. 3 500 Gesellschaften und über 500 000 Beschäftigten im Produzierenden Gewerbe und in ausgewählten Dienstleistungsbranchen einen wichtigen Bestandteil der ostdeutschen Wirtschaft (einschließlich Berlin). Nicht selten finden sich in dieser Gruppe große und technologieorientierte Unternehmen mit strukturbestimmendem Charakter. Das IWH befragt diese Unternehmen daher jährlich insbesondere zu ihren Forschungs- und Entwicklungsaktivitäten.

Aktuelle Trends: Motive auswärtiger Investoren für die Wahl des Standortes in Ostdeutschland

in: Wirtschaft im Wandel, No. 4, 2010

Abstract

Das IWH hat mit der dritten Welle der FDI-Mikrodatenbank im Herbst 2009 eine Befragung von ostdeutschen Unternehmen mit ausländischem und/oder westdeutschem multinationalem Investor durchgeführt. Dabei beantworteten die Unternehmen u. a. die Frage nach den strategischen Investitionsmotiven ihres ausländischen und/oder westdeutschen multinationalen Gesellschafters für die Neugründung eines Tochterunternehmens bzw. für die Beteiligung an einem bereits existierenden Unternehmen in den Neuen Bundesländern.

The Attractiveness of East Germany as Investment Location for Multinational Enterprises (MNEs)

in: Wirtschaft im Wandel, No. 6, 2010

Abstract

Der vorliegende Beitrag betrachtet zum einen die grundlegenden Investitionsmotive multinationaler Investoren in Ostdeutschland. Zum anderen wird untersucht, wie diese Investoren die Qualität ausgewählter Standortfaktoren in den Neuen Ländern bewerten. Im Gegensatz zu bisherigen Studien wird die Heterogenität multinationaler Unternehmen in der Analyse eingehend berücksichtigt. Die Untersuchung basiert auf der dritten Befragungswelle der IWH-FDI-Mikrodatenbank aus dem Jahr 2009, die eine repräsentative und umfangreiche Stichprobe multinationaler Investoren in der ostdeutschen Wirtschaft bietet. Die Ergebnisse belegen einen Paradigmenwechsel in der relativen Bedeutung grundlegender Investitionsmotive im Laufe der Transformation in den Neuen Ländern. Seit Mitte der 1990er Jahre ziehen sie verstärkt Investoren an, die auf die Produktdiversifikation oder technologische Vorteile abzielen, statt primär auf Kostenvorteile bei den Produktionsfaktoren oder die Ausdehnung ihrer bestehenden Produktion zu setzen. Dabei unterscheidet sich die Bedeutung der Investitionsmotive in Abhängigkeit vom Herkunftsland, der Art des Markteintritts und dem Wirtschaftszweig des multinationalen Investors. Was die Bewertung der gegebenen Standortfaktoren aus Sicht der Investoren betrifft, so schneidet die Qualität des soziokulturellen Umfelds am besten ab, gefolgt von Faktoren im Zusammenhang mit dem Potenzial für technologische Kooperationen, dem Angebot an Arbeitskräften sowie der Verfügbarkeit staatlicher Förderung. Auch in der Bewertung der Standortfaktoren zeigt sich, dass signifikante Unterschiede in Abhängigkeit vom Herkunftsland, aber auch je nach dem vorrangigen Investitionsmotiv des Investors bestehen. Abschließend identifiziert der Beitrag politischen Handlungsbedarf auf den Feldern Fachkräfteangebot sowie Technologie- und Investitionsförderung, um den Wirtschaftsstandort Neue Länder nachhaltig zu sichern.

Aktuelle Trends: Auswärtige Investoren in Ostdeutschland blicken zuversichtlich in das Jahr 2011

in: Wirtschaft im Wandel, No. 1, 2011

Abstract

Seit dem Jahr 2007 führt das IWH regelmäßig Befragungen auswärtiger Investoren in Ostdeutschland durch. In der Zeit von September bis Oktober 2010 hat das IWH 614 Tochtergesellschaften ausländischer und westdeutscher multinationaler Investoren mit Sitz in Ostdeutschland (einschließlich Berlin) zu ihren Erwartungen für das Geschäftsjahr 2011 befragt. Die Gruppe der befragten Unternehmen umfasst das Produzierende Gewerbe und ausgewählte Bereiche des Dienstleistungssektors. Diese Unternehmen haben in der ostdeutschen Wirtschaft ein erhebliches Gewicht. So arbeitet beispielsweise jeder vierte Arbeitsnehmer im Verarbeitenden Gewerbe in einem Unternehmen mit auswärtigem Investor.

Aktuelle Trends: Multinationale Investoren in Ostdeutschland erwarten keine Eintrübung der Geschäftsaussichten im Jahr 2013

in: Wirtschaft im Wandel, No. 1, 2013

Abstract

Das IWH führt in Ostdeutschland (inklusive Berlin) seit dem Jahr 2007 regelmäßig Befragungen von Tochterunternehmen multinationaler Konzerne mit Hauptsitz im Ausland bzw. in den westdeutschen Bundesländern durch. Im September 2012 wurden insgesamt 466 Tochterunternehmen bezüglich ihrer Geschäftserwartungen für das Jahr 2013 befragt. Die befragten Unternehmen gehören entweder dem Verarbeitenden Gewerbe oder ausgewählten Dienstleistungssektoren an. Ihr Gewicht in der ostdeutschen Wirtschaft ist erheblich: Beispielsweise ist jeder vierte Arbeitnehmer im Verarbeitenden Gewerbe bei einem Tochterunternehmen mit multinationalem Investor beschäftigt.

Monographs and contributions to edited volumes

J. Stephan (2013) The Technological Role of Inward Foreign Direct Investment in Central East Europe, Palgrave Macmillan, Houndsmill, Basingstoke.

B. Jindra (2011) Internationalisation Theory and Technological Accumulation - An Investigation of Multinational Affiliates in East Germany, Studies in Economic Transition, Palgrave Macmillan, Houndsmill, Basingstoke.

J. Stephan, J. Günther, and B. Jindra (2010): Foreign direct investment in national innovations systems – Evidence from emerging economies in Central and East Europe (CEE), in: Dyker. D. (ed.) Network Dynamics in Emerging Regions of Europe, Imperial College Press.

J. Stephan and L. Voinea (2009): Market Concentration and Innovation in Transitional Corporations: Evidence from Affiliates in Central and East Europe’, in: J. Larimo and T. Vissak (eds.) Knowledge, Innovation and Internationalization – Progress in International, Vol. 4, Bedfordshire, UK: Emerald Books.

J. Stephan (ed.) (2005): Technology Transfer via Foreign Direct Investment in Central and Eastern Europe: Theory - Methods of Research - Empirical Evidence, Palgrave Macmillan, Houndsmill, Basingstoke.

Other publications

Günther, Jutta (2013) „Internationale FuE-Standorte“, in: „Studien zum Deutschen Innovationssystem“ 11-2013. Abstract

B. Jindra (2010) Internationalisation theory and technological accumulation - an investigation of multinational affiliates in East Germany. PhD thesis, University of Sussex.

B. Jindra (2008): Foreign firms invest to unlock new markets and local technology, Invest in Germany Magazine, No. 02/2008, p. 17.

Publications (without IWH participation)

Refereed doubled blind journals

M. Dabić, D. Tugrul, Z. Aralica, A.E. Bayraktaroglu (2012): Exploring Relationships Among Internationalization, Choice For Research And Development Approach And Technology Source And Resulting Innovation Intensity : Case Of A Transition Country Croatia, in: Journal of High Technology Management Research Journal of High Technology Management Research. 23 (2012) , pp. 1; 15-25.

J. Stephan (2011): Foreign direct Investment in weak intellectual property rights regimes – the example of post-socialist economies, Post-Communist Economies, Vol. 23 (1), pp. 35 -53.

A. Szalavetz (2010): Outward direct investment versus licensing: An SME perspective. Competition, Vol. 8, Issue 2. forthcoming.

M. Rojec, M. Bučar and M. Stare (2009): Backward FDI linkages as a channel for transferring technology and building innovation capability: The case of Slovenia. European Journal of Development Research, Vol. 21, Issue 1, pp. 137-153.

Z. Aralica, D. Račić and D. Redžepagić (2009): R&D Activities as a Growth Factor of Foreign-Owned SMEs in Croatia, Croatian Economic Survey, Vol. 11, pp. 73-94.

M. Rojec, B. Majcen and S. Radošević (2009): Nature and determinants of productivity growth in foreign subsidiaries in Central and East European countries, Economic Systems, Vol. 33, Issue 2, pp. 168-184.

A. Kokko and V. Kravtsova (2008): Innovative capability in MNC subsidiaries: evidence from four European transition economies, Post-Communist Economies, Vol. 20, Issue 1, pp. 57-75.

Z. Aralica, D. Račić and D. Redžepagić (2008): Research and development activity as a growth factor of foreign owned SMEs in selected Central and Eastern European countries, Journal of Economics and Business, Vol. 26, Issue 2, pp. 279-300.

M. Rojec, B. Majcen, A. Jaklič and S. Radošević (2005): Productivity Growth and Functional Upgrading in Foreign Subsidiaries in the Slovenian Manufacturing Sector, Journal of East-West Economics and Business, Vol. 8 (1 & 2), pp. 73-100.

Monographs and contributions to edited volumes

Č. Kostevc, T. Redek, and M. Rojec (2010): Scope and effectiveness of FDI Policies in transition countries, in: Rugraff, E. and M. W. Hansen (eds.), Multinationals and Local Firms in Emerging Markets, Amsterdam (NL): Amsterdam University Press.

Z. Aralica, V. Gnjidić, D. Redžepagić (2009): Researching Innovation Strategies of Foreign Investment Enterprises: The Case of Croatia, 8th International Conference: Challenges of Europe, Financial Crisis and Climate Change Conference Proceeding CD ROMSplit - Bol : Ekonomski Fakultet, Split, pp. 445-459.

M. Dabić, D. Tugrul, Z. Aralica (2009): The role of Internationalization on the intensity of local innovation: Case of a transition country Croatia, The XX ISPIM Conference "The Future of Innovation": Book of Abstracts / Hulzingh, K.R.E.; Conn, S.; Torkkeli, M.; Bitran, I. (ur.). Vienna: ISPIM, pp. 212-212.

M. Dabić, Z. Aralica (2008): The role of Internationalisation of MNC for building high growth performance in the local subsidiaries: the case of Croatia, Conference on Competitiveness, Territory and Industrial Policy: 2008 EUNIP: proceeddings / Mari Jose Aranguren; James R. Wilson (ur.). San Sebastian: Orkestra, The Institute of Kompetitiveness and Development, and ESTE-University of Deusto, Spain.