The East German economy expanded strongly in the first half of 2022, but falls into recession in the second half of the year ‒ Implications of the Joint Economic Forecast Autumn 2022 and of Länder data from recent publications of the Statistical Office

In its Autumn Report, the Joint Economic Forecast Project Group states that the European energy crisis is leading to a massive reduction of purchasing power and pushing the German economy into recession. This also applies to the East German economy. In the first half of 2022, the economy in East Germany was still quite strong: Production was more than 3% higher than a year earlier, while in Germany as a whole the increase was only 2.6%.1 “The East German economy benefited from the fact that the weight of the weakening manufacturing sector is lower than in the west,” says Oliver Holtemöller, Head of the Department Macroeconomics and Vice President at the Halle Institute for Economic Research (IWH). The disposable incomes of private households in East Germany are being supported by the gradual alignment of East German pensions with those in the west; each year, East German pension increase is by about ¾ percentage points higher than in West Germany. Furthermore, the particularly strong increase in the minimum wage in 2022 plays a greater role in the east than in the west, since a significantly larger proportion of the workforce is affected by this measure. Due to the currently favourable labour market situation, the negative employment effects of the minimum wage increase have so far remained within narrow limits. “In addition, some of the widely noticed large-scale industrial projects in East Germany, such as the Tesla factory in Grünheide or new chip factories in Dresden, may already have measurable effects on the economy as a whole,” says Oliver Holtemöller.

These supporting effects, however, are small compared to the expected loss of purchasing power due to the sharp rise in energy prices. As in Germany as a whole, private consumption as well as production in East Germany will shrink in the coming winter. There are no major differences in the burden on households and businesses: Natural gas has roughly the same importance as a heating fuel in east and west,2 and the energy- and gas-intensive sectors of the manufacturing industry have roughly the same weight in East and West Germany.3

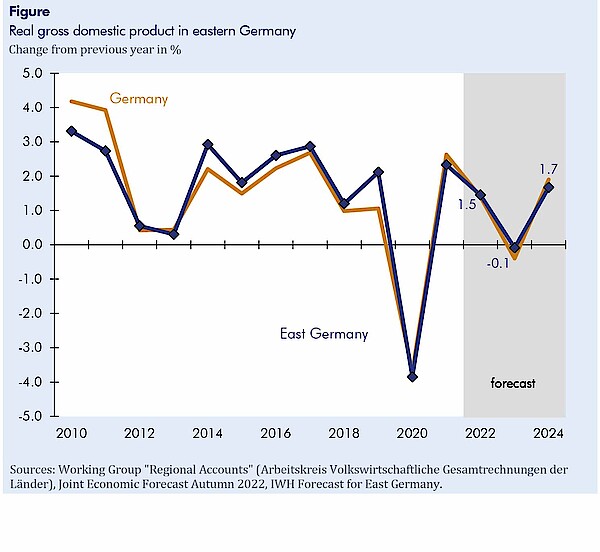

Overall, East German production will probably expand somewhat more strongly in 2022 (1.5%) than in Germany as a whole (1.4%, see figure). For 2023, the decline in East Germany is likely to be less pronounced than in the west at 0.1% (Germany: ‒0.4%), not least because the larger share of value added by public service providers in the east supports output in the crisis. For 2024, growth is forecast to be 1.7% (Germany: 1.9%). The East German unemployment rate as defined by the Federal Employment Agency rises from 6.8% in 2022 to 7.1% next year, only to fall back to 6.8% in 2024.

1 IWH calculation of the East German gross domestic product based on Länder data.

2 See Arbeitskreis Konjunktur des IWH: Energiekrise in Deutschland. IWH, Konjunktur aktuell, Jg. 10 (3), 2022, 78.

3 Of the 28 branches in the manufacturing industry, the five branches with the highest gas and energy intensity are (according to IWH calculations based on data from the Federal Statistical Office): Manufacture of paper and paperboard/Coking and refining of mineral oils/Manufacture of chemicals/Manufacture of glassware, ceramics and processing of stone and earth/Metal production and processing. In West Germany, these industries account for 11.5% of the total payrolls in manufacturing, in East Germany for 12%. This is a bit more mainly because the branch “manufacture of glassware, ceramics and processing of stones and earths” is of somewhat greater importance in the east.

Joint Economic Forecast, Autumn 2022 Report (in German):

Joint Economic Forecast: Energiekrise: Inflation, Rezession, Wohlstandsverlust. Essen, October 2022.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Energiekrise: Inflation, Rezession, Wohlstandsverlust

in: Dienstleistungsauftrag des Bundesministeriums für Wirtschaft und Klimaschutz, 2, 2022

Abstract

Die krisenhafte Zuspitzung auf den Gasmärkten belastet die deutsche Wirtschaft schwer. Durch die reduzierten Gaslieferungen aus Russland ist ein erheblicher Teil des Angebots weggefallen und auch das Risiko gestiegen, dass die verbleibenden Liefer- und Speichermengen im Winter nicht ausreichen, um die Nachfrage zu decken. Die Gaspreise sind in den Sommermonaten in die Höhe geschossen, und auch auf den Terminmärkten zeigen sich für einen längeren Zeitraum deutlich höhere Notierungen. Die dadurch stark steigenden Verbraucherpreise schmälern insbesondere die Kaufkraft der privaten Haushalte. Die Wirtschaftsleistung dürfte im dritten Quartal bereits leicht gesunken sein. Im Winterhalbjahr ist ein deutlicher Rückgang zu erwarten. Dass dieser nicht noch kräftiger ausfällt, ist dem hohen Auftragspolster im Verarbeitenden Gewerbe zu verdanken. Insgesamt dürfte die Produktion in diesem Jahr trotz des Rückgangs in der zweiten Jahreshälfte um 1,4% ausgeweitet werden. Damit halbieren die Institute ihre Prognose vom Frühjahr für dieses Jahr annähernd. Für das kommende Jahr ist zu erwarten, dass das Bruttoinlandsprodukt im Jahresdurchschnitt um 0,4% zurückgeht. Im Frühjahr erwarteten die Institute noch einen Anstieg von 3,1%. In dieser Revision zeigt sich das Ausmaß der Energiekrise. Im Jahr 2024 expandiert das Bruttoinlandsprodukt im Jahresdurchschnitt mit 1,9%. Die Inflationsrate dürfte sich in den kommenden Monaten weiter erhöhen. Jahresdurchschnittlich ergibt sich für das Jahr 2023 mit 8,8% eine Teuerungsrate, die leicht über dem Wert des laufenden Jahres (8,4%) liegt. Erst im Jahr 2024 wird die 2%-Marke allmählich wieder erreicht.