Centre for Evidence-based Policy Advice (IWH-CEP)

The Centre for Evidence-based Policy Advice (IWH-CEP) of the IWH was founded in 2014. It is a platform that bundles and structures activities in research, teaching, and policy advice. IWH-CEP pursues the objective of creating better foundations for a causal analysis of policy implemented across different sectors.

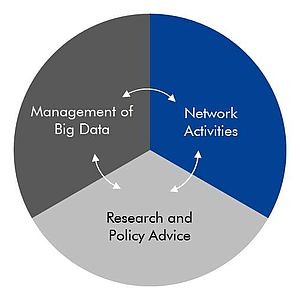

IWH-CEP is designed as a service unit and supports the activities in the research groups by providing access to a supra-regional research and policy advising network as well as access to data sets for causal analyses. IWH-CEP lies at the interface between three areas of responsibility and carries out coordination functions between them.

Tasks Team Events Projects Publications

IWH Subsidy Database Research Group "Evaluation of Subsidy Programmes"

The tasks of the IWH-CEP

The government intervenes in the market mechanism through a lot of policy instruments in order to achieve various economic objectives. However, for policy makers, it is important to know whether the originally intended objectives are also achieved. Scientific methods can make a significant contribution to this. These are necessary to establish a clear connection between a policy instrument and its effect. Against this background, the Centre for Evidence-based Policy Advice (IWH-CEP) at the IWH was founded.

Research and Policy Advice

Research and policy advice are organized via the different research groups of the IWH. This organizational structure allows to assess policy changes from both a macro and micro perspective and cover different sectors of the economy.

To gain a better understanding of structural changes and economic growth, a first focus is set on the evaluation of subsidy programmes for firms and regions, for example, the Joint Task of "Improving the Regional Economic Structure" (which is the most important regional policy support scheme in Germany) and the measures envisaged by the Coal Regions Investment Act (InvKG) are being evaluated on behalf of federal and state governments. The objective of the projects is to use advanced evaluation techniques to assess the impact of policy support measures. The projects are carried out under the responsibility of the IWH Research Group "Evaluation of Subsidy Programmes".

A second key area includes analyses on regulatory reforms and effects. Especially having in mind that after the recent financial crisis, a re-regulation of the financial system took place, it is of utmost importance to evaluate the effectiveness of the reforms as well as to assess whether there are unintended side-effects. In the context of the project The Political Economy of the European Banking Union, researchers in the financial markets department study how the directives underlying the European Banking Union are implemented across member states as well as whether the new regulatory framework has implications for banking stability and financial intermediation.

Set-up of a Network

The IWH-CEP sees itself as part of various initiatives in the field of evidence-based economic policy. This is to ensure the unit's visibility and the awareness of the issue among the scientific and policy community.

Set-up and Maintenance of Databases

The major challenge in the analysis of effects of government interventions and regulatory changes lies in the accessibility of administrative data. IWH-CEP advances into this direction by building up databases that can be shared with other researchers.

Therefore, the IWH Subsidy Database is set up, maintained and completed according to the (current) specialisation in the analysis of effects of industrial policy support schemes. Information about the funded projects alone is not sufficient to conduct causal analyses – corporate data provided by official and commercial statistics must be added; this is organised using record linkage techniques. This task is carried out at the IWH Research Data Centre.

Additionally, the financial market department has set up the website International Banking Library, which is a web-based platform for the exchange of research outcomes on cross-border banking. It provides access to data sources, academic research on cross-border banking, both theoretical and empirical, as well as information on regulatory initiatives. Thus, the website provides researchers and policymakers with a comprehensive overview of available data to conduct policy evaluation and the current stance of the literature on regulation and supervision of financial markets. The quarterly newsletter summarizes recent developments and is appreciateted by both academics and central bankers.

The website of the International Banking Library also allows access to the Financial Markets Directives Database. This database provides information about financial markets regulation in Europe since the last financial and sovereign debt crisis. One key element is the harmonization of rules for capital regulation, bank resolution and deposit insurance on the way to the European banking and capital market union. The first element of the database provides data on the implementation of the Capital Markets Union in the European Union (see Emlein, M.; Sfrappini, E.; Tonzer, L.; Zgherea, C.: Capital Markets Union: Database of Directives and Regulations. IWH Technical Reports 2/2022).

Your Contact

Research Group Head

If you have any further questions please contact me.

+49 345 7753-861 Request per E-MailEvents

The IWH-CEP organises the annual transfer conference "From Transition to European Integration". Under a current topic, the event connects representatives from politics, ministries, authorities, associations and companies with scientists from the IWH and its partner institutions. The opening speech is given by a prominent politician. After scientific lectures and discussions, a panel discussion concludes the one-day conference. The event is designed for the dissemination of IWH's research findings among political decision-makers and administrative professionals. There is also media coverage.

Projects

FLEXPANELDID: Stata module to perform causal analysis of treatments with varying start dates and durations

flexpaneldid: A Stata Toolbox for Causal Analysis with Varying Treatment Time and Duration

in: IWH Discussion Papers, No. 3, 2020

Abstract

The paper presents a modification of the matching and difference-in-differences approach of Heckman et al. (1998) for the staggered treatment adoption design and a Stata tool that implements the approach. This flexible conditional difference-in-differences approach is particularly useful for causal analysis of treatments with varying start dates and varying treatment durations. Introducing more flexibility enables the user to consider individual treatment periods for the treated observations and thus circumventing problems arising in canonical difference-in-differences approaches. The open-source flexpaneldid toolbox for Stata implements the developed approach and allows comprehensive robustness checks and quality tests. The core of the paper gives comprehensive examples to explain the use of the commands and its options on the basis of a publicly accessible data set.

09.2019 ‐ 09.2022

Establishing Evidence-based Evaluation Methods for Subsidy Programmes in Germany (EVA-KULT)

European Regional Development Fund (ERDF)

The project aims at expanding the Centre for Evidence-based Policy Advice at the Halle Institute for Economic Research (IWH-CEP).

Publications

The Regional Effects of a Place-based Policy – Causal Evidence from Germany

in: Regional Science and Urban Economics, November 2019

Abstract

The German government provides discretionary investment grants to structurally weak regions in order to reduce regional inequality. We use a regression discontinuity design that exploits an exogenous discrete jump in the probability of regional actors to receive investment grants to identify the causal effects of the policy. We find positive effects of the programme on district-level gross value-added and productivity growth, but no effects on employment and gross wage growth.

The Impact of Innovation and Innovation Subsidies on Economic Development in German Regions

in: Regional Studies, No. 9, 2019

Abstract

Public innovation subsidies in a regional environment are expected to unfold a positive economic impact over time. The focus of this paper is on an assessment of the long-run impact of innovation and innovation subsidies in German regions. This is scrutinized by an estimation approach combining panel model and time-series characteristics and using regional data for the years 1980–2014. The results show that innovation and innovation subsidies in the long run have a positive impact on the economic development of regions in Germany. This supports a long-term strategy for regional and innovation policy.

Do Diasporas Affect Regional Knowledge Transfer within Host Countries? A Panel Analysis of German R&D Collaborations

in: Regional Studies, No. 1, 2019

Abstract

Interactive regional learning involving various actors is considered a precondition for successful innovations and, hence, for regional development. Diasporas as non-native ethnic groups are regarded as beneficial since they enrich the creative class by broadening the cultural base and introducing new routines. Using data on research and development (R&D) collaboration projects, the analysis provides tentative evidence that the size of diasporas positively affects the region’s share of outward R&D linkages enabling the exchange of knowledge. The empirical analysis further confirms that these interactions mainly occur between regions hosting the same diasporas, pointing to a positive effect of ethnic proximity rather than ethnic diversity.

IWH-Subventionsdatenbank: Mikrodaten zu Programmen direkter Unternehmenssubventionen in Deutschland. Datendokumentation

in: IWH Technical Reports, No. 2, 2018

Abstract

Nahezu alle entwickelten Volkswirtschaften haben Programme zur Förderung von Projekten in Unternehmen im Rahmen von Industriepolitik eingeführt. Allerdings ist sehr wenig darüber bekannt, welche Programme eigentlich genau zur Anwendung kommen, welche finanziellen Mittel dafür aufgebracht werden und ob die Programme in der Art und Weise wirken, wie sie ursprünglich intendiert waren. Evaluationsstudien, die auf kausalen Untersuchungsdesigns basieren, können einen wertvollen Beitrag zur Beantwortung der Frage leisten, ob ein Programm tatsächlich Wirkungen entfaltet und welcher der verschiedenen Ansätze am erfolgversprechendsten ist. Dieser Datenreport stellt die vom Zentrum für evidenzbasierte Politikberatung am Leibniz-Institut für Wirtschaftsforschung Halle (IWH-CEP) entwickelte IWH-Subventionsdatenbank vor. Die Datenbank enthält (Stand November 2018) zehn Programme industriepolitischer Maßnahmen, die in Deutschland zur Anwendung kamen bzw. kommen. Der Report geht auf die Förderregeln dieser Programme ein und beschreibt die Prozeduren der Zusammenführung zu einer Masterdatei. Ferner diskutiert der Report Möglichkeiten der Verknüpfung der Förderdaten mit externen Unternehmensdatensätzen, die eine zwingende Voraussetzung für die Durchführung von Wirkungsanalysen darstellen, da die administrativen Förderdaten nicht alle Informationen enthalten, die für kausale Untersuchungsdesigns notwendig sind.

Expertisen zur Evaluation der Gemeinschaftsaufgabe „Verbesserung der regionalen Wirtschaftsstruktur“ (GRW) in Sachsen-Anhalt

in: IWH Online, No. 2, 2018

Abstract

Investitionszuschüsse im Rahmen der Gemeinschaftsaufgabe „Verbesserung der regionalen Wirtschaftsstruktur“ (GRW) haben eine hohe Bedeutung im Rahmen der Wirtschaftsförderung des Landes Sachsen-Anhalt. Die Ziele der GRW-Förderung in Sachsen-Anhalt umfassen den Aufbau einer breitgefächerten, modernen Wirtschaftsstruktur, die Modernisierung und Erneuerung des Kapitalstocks, die Steigerung der Arbeitsproduktivität und die Schaffung neuer wettbewerbsfähiger Arbeitsplätze. Die vorliegenden drei Expertisen evaluieren diese Förderung mit Blick auf die GRW-Landesregeln, den Zusammenhang zwischen den wirtschaftspolitischen Maßnahmen und deren Wirkung sowie die Beschäftigungseffekte als einen Schwerpunkt der gewerblichen Förderung.

Public Investment Subsidies and Firm Performance – Evidence from Germany

in: Jahrbücher für Nationalökonomie und Statistik, No. 2, 2018

Abstract

This paper assesses firm-level effects of the single largest investment subsidy programme in Germany. The analysis considers grants allocated to firms in East German regions over the period 2007 to 2013 under the regional policy scheme Joint Task ‘Improving Regional Economic Structures’ (GRW). We apply a coarsened exact matching (CEM) in combination with a fixed effects difference-in-differences (FEDiD) estimator to identify the effects of programme participation on the treated firms. For the assessment, we use administrative data from the Federal Statistical Office and the Offices of the Länder to demonstrate that this administrative database offers a huge potential for evidence-based policy advice. The results suggest that investment subsidies have a positive impact on different dimensions of firm development, but do not affect overall firm competitiveness. We find positive short- and medium-run effects on firm employment. The effects on firm turnover remain significant and positive only in the medium-run. Gross fixed capital formation responses positively to GRW funding only during the mean implementation period of the projects but becomes insignificant afterwards. Finally, the effect of GRW-funding on labour productivity remains insignificant throughout the whole period of analysis.

Evaluierung des Einsatzes von Fördermitteln im Rahmen der Gemeinschaftsaufgabe „Verbesserung der regionalen Wirtschaftsstruktur“ (GRW) in Thüringen für den Zeitraum 2011 – 2016

in: IWH Online, No. 1, 2018

Abstract

Die Investitionszuschüsse im Rahmen der Gemeinschaftsaufgabe „Verbesserung der regionalen Wirtschaftsstruktur“ (GRW) stellen nach wie vor das quantitativ bedeutendste Förderinstrument mit explizit regionaler Zielsetzung in Deutschland dar. Das Oberziel dieses Programms besteht in der Reduzierung regionaler Disparitäten. Es soll damit einen Beitrag zu dem im Grundgesetz Artikel 72(2) verankerten Ziel der Herstellung gleichwertiger Lebensverhältnisse im Bundesgebiet leisten. Auf der Mikroebene, d. h. der Ebene der Betriebe, zielt die GRW auf die Schaffung und Sicherung dauerhafter und hochwertiger Arbeitsplätze. Dadurch sollen – so das Ziel auf der Makroebene – strukturschwache Gebiete Anschluss an die allgemeine Wirtschaftsentwicklung in Deutschland halten und nicht dauerhaft zurückfallen. Die Eckpunkte für den Einsatz dieses Programms legen der Bund und die Länder im GRW-Koordinierungsrahmen fest. Jedoch können die Länder weitere Eingrenzungen gegenüber diesen allgemeinen Regelungen vornehmen, um auf die regionalspezifischen Bedingungen vor Ort Rücksicht zu nehmen. Mit dem Koalitionsvertrag für die 18. Legislaturperiode auf der Bundesebene wurde die Aufgabe einer Weiterentwicklung eines Systems der Förderung strukturschwacher Regionen festgelegt (vgl. CDU, CSU und SPD 2013). Die Weiterentwicklung des Fördersystems wird vor allem deshalb notwendig, weil sich die finanzpolitischen und beihilferechtlichen Rahmenbedingungen – insbesondere in den neuen Ländern – in naher Zukunft weiter verändern werden (Auslaufen der Sonderbedarfs-Bundesergänzungszuweisungen, Greifen der Schuldenbremse, Einschränkung der Fördermöglichkeiten durch das EU-Beihilferecht). Erste Überlegungen zur Anpassung des Fördersystems sehen im Kern eine reformierte GRW vor, die im Zusammenspiel mit wirtschaftsnahen Förderprogrammen (vornehmlich FuE- sowie KMU-Programme des Bundes) sowie nicht unmittelbar wirtschaftsnahen Förderprogrammen (bspw. Städtebauförderung) zum Einsatz kommen soll. Eine Empfehlung für die reformierte GRW lautet, die bisherigen Fördervoraussetzungen (insbesondere Primäreffekt, besondere Anstrengung, Begrenzung der Förderung pro Arbeitsplatz) auf den Prüfstand zu stellen und verstärkt Augenmerk auf Netzwerkbildung, Forschungs- und Innovationsförderung zu richten (vgl. GEFRA, RUFIS 2016). In der jüngeren Vergangenheit ist das Bewusstsein bei den wirtschaftspolitischen Verantwortungsträgern dafür gewachsen, dass staatliche Eingriffe umfassenden Evaluationen unterzogen werden sollten (vgl. Brachert et al. 2015). Gegenstand ist die Beantwortung der Frage, ob ein Programm eine (kausale) Wirkung auf ex ante bestimmte ökonomische Zielvariablen entfaltet (Effektivität) und ob die Fördermittel tatsächlich in die beste Verwendung fließen (Effizienz). Das Programmmanagement der GRW nimmt diesbezüglich zweifelsohne eine Vorreiterrolle in Deutschland, ein, auch wenn viele Fragen noch nicht abschließend beantwortet sind (vgl. WissBeirat BMWi 2013 und 2015). Von 1991-2016 setzte der Freistaat Thüringen GRW-Mittel im Umfang von ungefähr 9,5 Mrd. Euro ein. In den 1990er Jahren betrug das jährliche GRW-Volumen noch zwischen rund 300 und knapp 900 Mio. Euro. Seit Ende der 1990er Jahre – mit Ausnahme der Zeit der Wirtschafts- und Finanzkrise zwischen 2008 und 2013 – ist der Umfang der GRW-Mittel kontinuierlich abgeschmolzen. Im Jahr 2016 wurden „nur“ noch 157 Mio. Euro an GRW-Mitteln im Freistaat Thüringen eingesetzt. Dies bedeutet, dass die Höhe der Anreize, die heute mit der GRW gesetzt werden können, geringer ist. Nach einem bedeutenden Anstieg der wirtschaftlichen Leistungsfähigkeit im Gefolge der Wiederherstellung der Deutschen Einheit ist der Aufholprozess Ostdeutschlands seit Mitte der 1990er Jahre ins Stocken geraten. Neuere Untersuchungen zur wirtschaftlichen Entwicklung in den neuen Ländern weisen darauf hin, dass der Aufbau eines modernen Kapitalstocks (welcher im Fokus der GRW steht) und die Reallokation von Ressourcen von weniger produktiven Bereichen in Bereiche mit höherer Produktivität – die den Aufholprozess in der ersten Phase maßgeblich getrieben haben – für den weiteren Angleichungsprozess nur wenig zusätzliche Impulse setzen können. Dagegen spielen in der nächsten Phase des Aufholprozesses Humankapital und Innovationen die entscheidende Rolle (vgl. Brautzsch et al. 2016). Vor diesem Hintergrund ist die ausgeschriebene Studie angelegt. Sie zielt darauf ab, den Einsatz der GRW-Mittel ex post vor dem Hintergrund der wirtschaftlichen Entwicklung und der Zielsetzungen der GRW und der Förderpolitik des Thüringer Ministeriums für Wirtschaft, Wissenschaft und Digitale Gesellschaft (TMWWDG) zu analysieren, und konkrete Empfehlungen für die Weiterentwicklung und künftige Ausrichtung der Thüringer GRW-Förderung und der sie begleitenden Programme Thüringen-Invest sowie Thüringen-Dynamik zu geben. Die nächste bedeutende Änderung wird die Anpassung der Förderhöchstsätze der prä-definierten C-Fördergebiete an diejenigen der nicht prä-definierten (vornehmlich in Westdeutschland beheimateten) C-Fördergebiete sein (Absenkung der Förderhöchstsätze um 5 Prozentpunkte; vgl. Leitlinien für staatliche Beihilfen mit regionaler Zielsetzung 2014 – 2020 – Regionalleitlinien [RLL] [ABl. C 209 vom 23.7.2013, S. 1]).

Who Benefits from GRW? Heterogeneous Employment Effects of Investment Subsidies in Saxony Anhalt

in: IWH Discussion Papers, No. 27, 2017

Abstract

The paper estimates the plant level employment effects of investment subsidies in one of the most strongly subsidized German Federal States. We analyze the treated plants as a whole, as well as the influence of heterogeneity in plant characteristics and the economic environment. Modifying the standard matching and difference-in-difference approach, we develop a new procedure that is particularly useful for the evaluation of funding programs with individual treatment phases within the funding period. Our data base combines treatment, employment and regional information from different sources. So, we can relate the absolute effects to the amount of the subsidy paid. The results suggest that investment subsidies have a positive influence on the employment development in absolute and standardized figures – with considerable effect heterogeneity.

Central Bank Transparency and Cross-border Banking

in: Journal of International Money and Finance, 2017

Abstract

We analyze the effect of central bank transparency on cross-border bank activities. Based on a panel gravity model for cross-border bank claims for 21 home and 47 destination countries from 1998 to 2010, we find strong empirical evidence that a rise in central bank transparency in the destination country, on average, increases cross-border claims. Using interaction models, we find that the positive effect of central bank transparency on cross-border claims is only significant if the central bank is politically independent and operates in a stable economic environment. Central bank transparency and credibility are thus considered complements by banks investing abroad.

Joint R&D Subsidies, Related Variety, and Regional Innovation

in: International Regional Science Review, No. 3, 2017

Abstract

Subsidies for research and development (R&D) are an important tool of public R&D policy, which motivates extensive scientific analyses and evaluations. This article adds to this literature by arguing that the effects of R&D subsidies go beyond the extension of organizations’ monetary resources invested into R&D. It is argued that collaboration induced by subsidized joint R&D projects yield significant effects that are missed in traditional analyses. An empirical study on the level of German labor market regions substantiates this claim, showing that collaborative R&D subsidies impact regions’ innovation growth when providing access to related variety and embedding regions into central positions in cross-regional knowledge networks.