Joint Economic Forecast 1/2024: Headwinds from Germany and abroad: institutes revise forecast significantly downwards

"Cyclical and structural factors are overlapping in the sluggish overall economic development. Although a recovery is likely to set in from the spring, the overall momentum will not be too strong," says Stefan Kooths, Head of Economic Research at the Kiel Institute for the World Economy.

In the current year, private consumption will become the most important driving force for the economy, followed by stronger exports in the coming year.

Economic output is currently at a level that is barely higher than before the pandemic. Since then, productivity in Germany has been at a standstill. There have recently been more headwinds than tailwinds in the domestic and foreign economies.

Private consumption picked up later and less dynamically than previously expected by the Joint Economic Forecast Project Group. German exports declined despite rising global economic activity, primarily because demand for capital and intermediate goods, which are important for Germany, was weak and price competitiveness for energy-intensive goods suffered.

Ongoing uncertainty about economic policy is weighing on corporate investment, which is likely to remain at the 2017 level despite the expected upturn in the coming year.

Nominal effective wages are expected to increase by 4.6% and 3.4% in 2024 and 2025 respectively. This means that real wages will increase over the entire forecast period and make up for the losses from 2022 and the first half of 2023. However, the level seen at the end of 2021, before the drastic surge in inflation, is not expected to be reached until the second quarter of 2025.

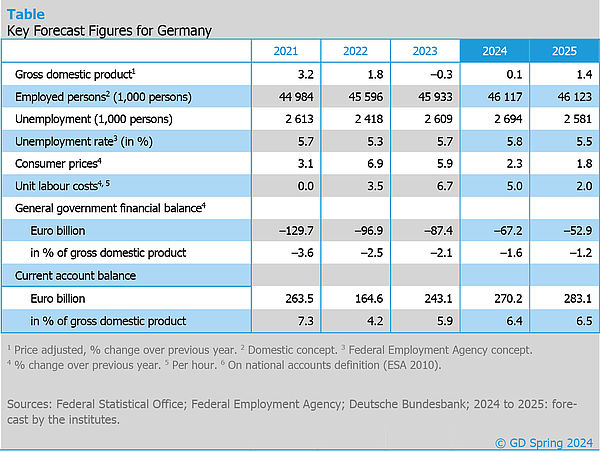

Overall, the institutes expect consumer prices to rise by 2.3% in the current year and by 1.8% in the coming year. Adjusted for the dampening effect of energy prices, core inflation rates are 2.8% (2024) and 2.3% (2025).

A robust labour market is supporting consumption-related upward forces. Although real unit labour costs are rising again significantly in the wake of wage increases, they remain supportive for labour demand.

Unemployment is likely to rise only slightly and fall again starting from spring onwards. Over the course of the year, the unemployment rate is likely to be 5.8% (2024) and 5.5% (2025).

The deficits in the general government budget in relation to economic output will fall from 2.1% in the previous year to 1.6% (2024) and 1.2% (2025). The public sector revenue ratio will reach record levels for Germany as a whole in the two forecast years at 47.5% and 48.4% respectively.

With regards to the debt brake, the experts recommend a mild reform. While supporting the proposal of Deutsche Bundesbank, which allows for more debt-financed investments than before, the institutes also suggest a transition phase for reactivating the deficit limit instead of an abrupt tightening.

More important, however, is a reorganisation of the overall fiscal constitution in order to better shield municipal investment activity – a good 40% of total public investment – from cyclical budget shortfalls.

Full-length version of the report (in German)

Joint Economic Forecast Project Group: Deutsche Wirtschaft kränkelt – Reform der Schuldenbremse kein Allheilmittel. Spring 2024. Halle (Saale) 2024.

The full-length version of the report is available here.

About the Joint Economic Forecast

The Joint Economic Forecast is published twice a year on behalf of the German Federal Ministry for Economic Affairs and Climate Action. The following institutes participated in the spring report 2024:

- German Institute for Economic Research (DIW Berlin)

- ifo Institute – Leibniz Institute for Economic Research at the University of Munich in cooperation with the Austrian Institute of Economic Research (WIFO) Vienna

- Kiel Institute for the World Economy (IfW Kiel)

- Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

- RWI – Leibniz Institute for Economic Research in cooperation with the Institute for Advanced Studies Vienna

Scientific Contacts

Professor Dr Stefan Kooths

Kiel Institute for the World Economy (IfW Kiel)

Phone +49 431 8814 579 or +49 30 2067 9664

Stefan.Kooths@ifw-kiel.de

Dr Timm Bönke

German Institute for Economic Research (DIW Berlin)

Phone +49 30 89789 485

tboenke@diw.de

Professor Dr Timo Wollmershäuser

ifo Institute – Leibniz Institute for Economic Research at the University of Munich

Phone +49 89 9224 1406

Wollmershaeuser@ifo.de

Professor Dr Oliver Holtemöller

Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

Phone +49 345 7753 800

Oliver.Holtemoeller@iwh-halle.de

Professor Dr Torsten Schmidt

RWI – Leibniz Institute for Economic Research

Phone +49 201 8149 287

Torsten.Schmidt@rwi-essen.de

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Deutsche Wirtschaft kränkelt – Reform der Schuldenbremse kein Allheilmittel

in: Dienstleistungsauftrag des Bundesministeriums für Wirtschaft und Klimaschutz, 1, 2024

Abstract

Die Wirtschaft in Deutschland ist angeschlagen. Eine bis zuletzt zähe konjunkturelle Schwächephase geht mit schwindenden Wachstumskräften einher. In der lahmenden gesamtwirtschaftlichen Entwicklung überlagern sich somit konjunkturelle und strukturelle Faktoren. Zwar dürfte ab dem Frühjahr eine Erholung einsetzen, die Dynamik wird aber insgesamt nicht allzu groß ausfallen. Zeitlich verzögert und in abgeschwächter Form hat das konjunkturelle Grundmuster, das die Institute im vergangenen Herbstgutachten gezeichnet hatten, im Prognosezeitraum weiterhin Bestand. Im laufenden Jahr avanciert der private Konsum zur wichtigsten Triebkraft für die Konjunktur. Nachdem der ab Mitte 2021 einsetzende Teuerungsschub die Massenkaufkraft zwei Jahre lang drastisch geschmälert hatte, steigen die real verfügbaren Einkommen nun wieder deutlich. Zum einen bildet sich der kräftige Preisauftrieb weiter zurück, zum anderen werden nun mehr und mehr höhere Lohnabschlüsse wirksam, die zunächst nur verzögert an die hohe Geldentwertung angepasst werden konnten. Zudem schlägt auch bei den monetären Sozialleistungen in beiden Prognosejahren wieder ein deutliches reales Plus zu Buche. Damit fließt insgesamt mehr Kaufkraft an private Haushalte. Während somit in diesem Jahr die konsumbezogenen Auftriebskräfte dominieren, trägt im kommenden Jahr vermehrt das Auslandsgeschäft die Konjunktur. Alles in allem revidieren die Institute ihre Prognose für die Veränderung des Bruttoinlandsprodukts im laufenden Jahr gegenüber ihrem Herbstgutachten deutlich um 1,2 Prozentpunkte nach unten auf nunmehr 0,1 %. Die Prognose für die Rate im kommenden Jahr bleibt mit 1,4 % nahezu unverändert (Rücknahme um 0,1 Prozentpunkte), geht aber mit einem um über 30 Mrd. Euro geringeren Volumen der Wirtschaftsleistung einher. Die Werte für die jahresdurchschnittliche Veränderung überzeichnen die Unterschiede in der konjunkturellen Dynamik beider Jahre, die ausweislich der jeweiligen Verlaufsraten mit 1,0 % und 1,5 % weniger ausgeprägt sind. Gleichwohl verlagert sich die Erholung nunmehr stärker in das kommende Jahr.