Recovery on shaky ground – tariffs dampen growth, but a change in fiscal policy is on the way

US tariffs were raised drastically in the summer. The financial markets reacted to this calmly, probably because the global economy has up to now remained fairly robust despite the trade conflicts. Monetary policy has been loosened almost everywhere recently. In the US this was done only hesitantly, but for the coming quarters we expect the Fed to lower interest rates further. Fiscal policy in advanced economies is broadly neutral. Overall, the global economy is likely to continue expanding at a moderate pace, but in autumn the sharp US tariff increases will dampen global trade and production. Slightly stronger growth rates are expected for the rest of 2026, partly due to investments in the implementation of new technologies. All in all, global production will increase by 2.6% in 2025 and by 2.4% in the following year.

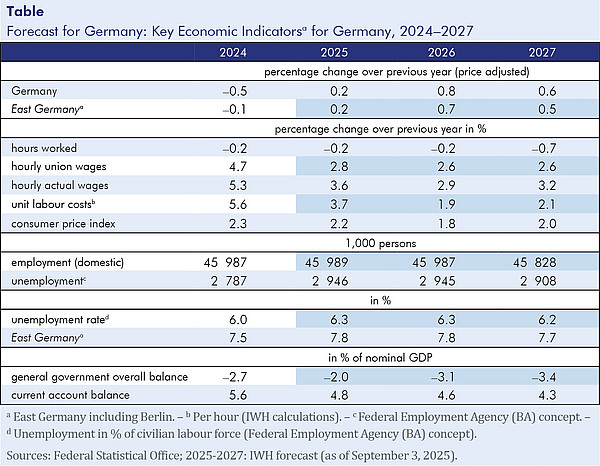

With the revision of data by the Federal Statistical Office, Germany's economic situation looks worse than before: we now know that production declined from the end of 2022 to mid-2024. Production expanded again in the winter half-year, but gross domestic product has recently contracted once again. Exports to the US have fallen following the elimination of pull-forward effects due to expected tariff increases, and there has been a very significant decline in housing investment. “The question arises as to whether the recovery that emerged in the winter months has merely been interrupted or whether the economy is still in a recession,” says Oliver Holtemöller, head of the Macroeconomics Department and Vice President at the IWH. So far, there are no signs of easing on the labour market. Capacity utilisation in the manufacturing sector, as derived from company surveys, has risen minimally recently, although industrial production has fallen. According to the ifo Business Climate Index, companies continue to assess their business situation as poor, but their expectations have risen. One reason for this could be the hope for positive effects from the extensive public investment programme. This is expected to take effect not before 2026. Because monetary policy is also likely to become somewhat more expansionary, the conditions for a recovery of the German economy in 2026 are quite favorable.

“Significant risks to the German economy lie in the uncertainty surrounding the future development of international trade,” says Oliver Holtemöller. This forecast takes into account losses due to higher US tariffs. The competitive position of German manufacturing, however, has been deteriorating for years in the face of foreign competition. Exports are losing their economic momentum for technological reasons. In addition, there will be a significant increase in the terms of trade this year due to the appreciation of the euro, not only against the US dollar but also against the Chinese renminbi. “Exports will probably fall as a reaction to the tariff increases in the summer, but if the decline continues into 2026, a sustained economic recovery is unlikely,” the IWH economist says.

The extended version of this forecast contains three boxes (all in German):

Box 1: On the current US tariff policy

Box 2: On the latest revision of the national accounts

Box 3: On the estimation of potential output

Publication:

Buhmann, Lukas; Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Kozyrev, Boris; Lindner, Axel; Mukherjee, Sukanya; Sardone, Alessandro; Schultz, Birgit; Zeddies, Götz: Konjunktur aktuell: Erholung auf schwachen Füßen – Zölle bremsen, fiskalpolitischer Kurswechsel steht bevor. IWH, Konjunktur aktuell, Jg. 13 (3), 2025. Halle (Saale) 2025

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-765 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Erholung auf schwachen Füßen – Zölle bremsen, fiskalpolitischer Kurswechsel steht bevor

in: Konjunktur aktuell, 3, 2025

Abstract

<p>Trotz der Handelskonflikte zeigt sich die Weltwirtschaft bislang robust und dürfte weiter in mäßigem Tempo expandieren. Die Weltproduktion steigt im Jahr 2025 um 2,6% und im Jahr darauf um 2,4%. Ob sich die deutsche Wirtschaft auf Erholungskurs befindet, ist weiterhin nicht erkennbar, zumal sie in der zweiten Jahreshälfte den Dämpfer höherer US-Zölle zu verkraften hat. Erst für 2026 stehen die Chancen gut, dass finanzpolitische Impulse zusammen mit niedrigen Leitzinsen eine konjunkturelle Belebung bewirken. Das Bruttoinlandsprodukt dürfte dann um 0,8% zunehmen, nach 0,2% im Jahr 2025.</p>