IWH Bankruptcy Update: Wave of bankruptcies in retail and hospitality has yet to materialise as downward trend in statistics continues

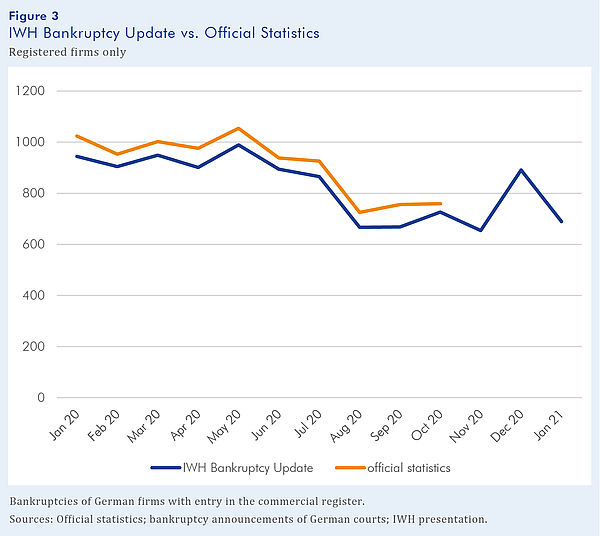

After a noticeable increase in December, the number of corporate bankruptcies in Germany trended downward in January 2021. According to data from the most recent IWH Bankruptcy Update, 689 companies filed for bankruptcy in the first month of the year. This was 23% below the December 2020 figures but slightly above the average of the previous three months. One reason for the unexpected decline in January could be renewed filing requirement exemptions for certain companies.

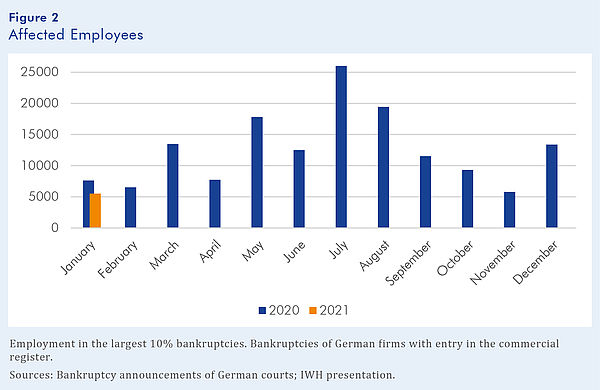

As in previous months, bankruptcies affected relatively few jobs. According to IWH research, the largest 10% of companies declaring bankruptcy in January employ a total of 5,500 people, which is below any other month in 2020. The 10% largest companies make up the vast majority of all job losses due to insolvency. (For a detailed description, see IWH Policy Note 2/2021.)

Steffen Müller, IWH’s head of the Department of Structural Change and Productivity and the director of Bankruptcy Research, attributes the low insolvency numbers to a mixture of state aid measures, exemptions to the filing requirement, and a wait-and-see attitude on the part of companies. “Many companies entered the crisis with healthy levels of liquidity,” he explains. “This allows them to hold out until the post-crisis recovery.” (For a detailed description, see IWH Policy Note 2/2021.)

The obligation to file for bankruptcy was recently suspended until April for companies eligible for “November and December aid” from the federal government. This is likely to dampen the bankruptcy trend through spring. “An analysis of our leading indicators suggests that a wave of insolvencies in the coming months is unlikely," Müller said.

In particular, leading indicators predict no near-term increase in bankruptcies in retail and hospitality, sectors that have been hit hard by the lockdown. According to IWH, this is a sign of the effectiveness of federal aid in November and December and of companies’ making use of the filing requirement exemptions. In October, after the filing exemption was temporarily rescinded, companies in these sectors saw a disproportionately high number of bankruptcies. This suggests that the number of insolvencies in retail and hospitality could increase once the filing obligation is reinstated.

The IWH Bankruptcy Update is a flash indicator, delivering fast, reliable information on insolvencies in Germany two months ahead of the comprehensive official statistics. It is based on public bankruptcy announcements of German courts combined with balance sheet information of the concerned companies. Because substantial delays can occur between a bankruptcy filing and public disclosure, some of the current numbers reflect bankruptcies that happened several weeks or months ago. The IWH Bankruptcy Research Unit is among Germany’s leading investigators of the causes and consequences of corporate bankruptcy.

For more on the IWH Bankruptcy Research Unit and the methodology underlying it, please visit https://www.iwh-halle.de/en/research/data-and-analysis/iwh-bankruptcy-research/.

Publication (in German):

Müller, Steffen: Insolvenzen in der Corona-Krise. IWH Policy Note 2/2021, Halle (Saale) 2021.

Whom to contact

For Researchers

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-720 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Insolvenzen in der Corona-Krise

in: IWH Policy Notes, 2, 2021

Abstract

Die Insolvenzzahlen sind trotz Corona-Krise im Jahr 2020 stark gesunken. Diese paradoxe Situation kann in erster Linie durch staatliche Unterstützungsmaßnahmen und abwartendes Verhalten bei den Unternehmen erklärt werden. Die Krise traf die meisten Unternehmen am Ende einer langanhaltenden wirtschaftlichen Boomphase und somit haben viele Unternehmen umfangreiche Reserven aufgebaut, die sie in Erwartung eines Nach-Corona Booms aufbrauchen. Obwohl eine Insolvenzwelle ab Frühjahr nicht auszuschließen ist, ist sie doch eher unwahrscheinlich. Der Staat muss seine Kräfte bündeln um ein Wiederaufflammen der Pandemie nach dem Sommer 2021 zu verhindern und gleichzeitig die Stützungsmaßnahmen bereits im Jahr 2021 beenden, um eine „Zombifizierung“ der Wirtschaft zu unterbinden.