Much more bankruptcies expected than currently observed in Germany

The corona pandemic has driven the German economy into a deep recession. Since mid-March 2020, important parts of the economy have been in shutdown. Revenues have suddenly declined. In order to prevent an increase in bankruptcies, the German government has introduced exception rules for insolvency registration. In addition, the state granted financial support to affected firms.

According to figures of the German Federal Statistical Office, in the period January to August 2020, there were actually in total 11% fewer bankruptcies than in the same period of the previous year. According to the IWH Bankruptcy Update they also do not appear to have significantly risen in the period from September to November. However, it should be taken into account that for many years there has been a declining trend for bankruptcies in Germany.

The IWH, therefore, initially calculated how many bankruptcies would have been expected up to August 2020 based on past development, without taking the corona recession into account. Result: In the months January to August 2020, there were 518 fewer bankruptcies than expected. Up to July, the value still fell within the range of the usual fluctuations; however, in August, it was significantly lower. “Compared to the forecast on the basis of the development for the previous years the actual number of bankruptcies is unusually low,” says Oliver Holtemöller, Head of the Department Macroeconomics and Vice-President of the IWH.

In a second step, the IWH researcher factored in the corona recession. For his forecast of the development of bankruptcies up to the end of 2020, he used the fact that bankruptcies are cyclically linked to economic development and react to fluctuations in gross value added with a delay of approximately two quarters.

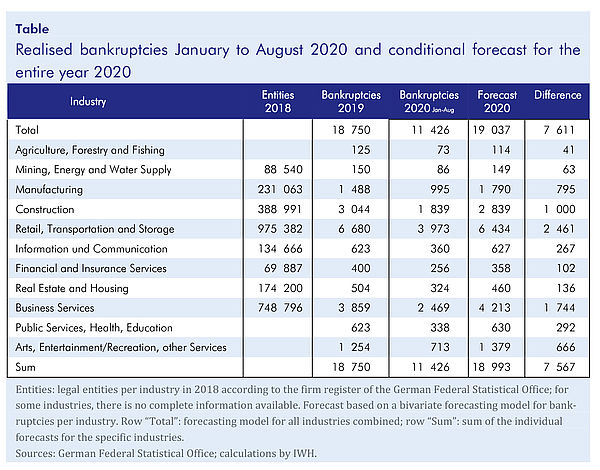

According to that forecast, for the second half of 2020, a significant increase in bankruptcies should be expected, even if the economy quickly recovers. For 2020, Holtemöller expects a total of 19,037 bankruptcies. Therefore, a further 7,611 bankruptcies would be added to the reported 11,426 bankruptcies up to August 2020 if the insolvency dynamic followed the usual economic pattern. The worst-hit sectors of the economy in absolute terms would be manufacturing industry, the construction industry, retail, transportation and storage, the hospitality industry and the business services sector (see table).

However, the current exception rules and fiscal support programmes are dampening the bankruptcy dynamic. The actual bankruptcy figures in 2020 are thus likely to be lower than forecasted here. “Some firms may succeed in adapting to the new circumstances and avoid bankruptcy. However, the exception rules and government transfers will not halt the wave of bankruptcies completely,” says Holtemöller.

Publication (in German)

Oliver Holtemöller: Unternehmensinsolvenzen in Deutschland im Zuge der Corona-Krise, in: IWH, Wirtschaft im Wandel, Jg. 27 (1), 2021.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-738 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.